Australia’s Taxation Statistics report for the 2020-21 financial year presents an overview of Australia’s income tax returns, including for individuals. From this data, it’s possible to get a snapshot of the highest-paid jobs in the country.

If you’re looking for a sneak peek, allow us to help. Here’s a list of the top-ten paying jobs in Australia, along with the top ten highest-earning postcodes in the country.

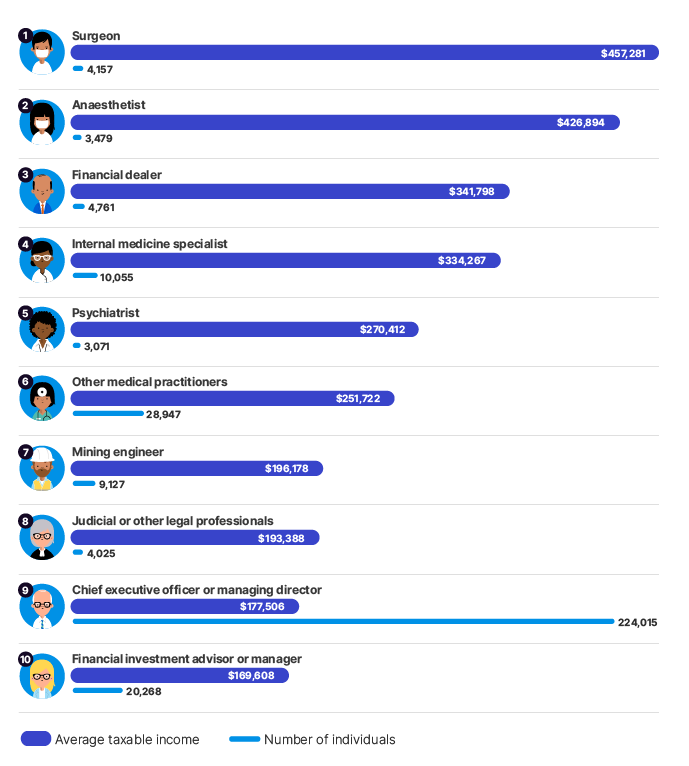

Which are the highest-paying jobs in Australia?

If you had to guess the highest-paid profession in Australia, you’d probably throw out a position in the mining or financial sectors. Nope. It turns out that the highest taxable income comes from surgeons. On average, surgeons make $457,281 in taxable income per year.

Only one of the job titles on the list changed over the year – engineering manager has been replaced by CEO or managing director. The order of the titles has also shifted a little bit.

Here’s the full list for you:

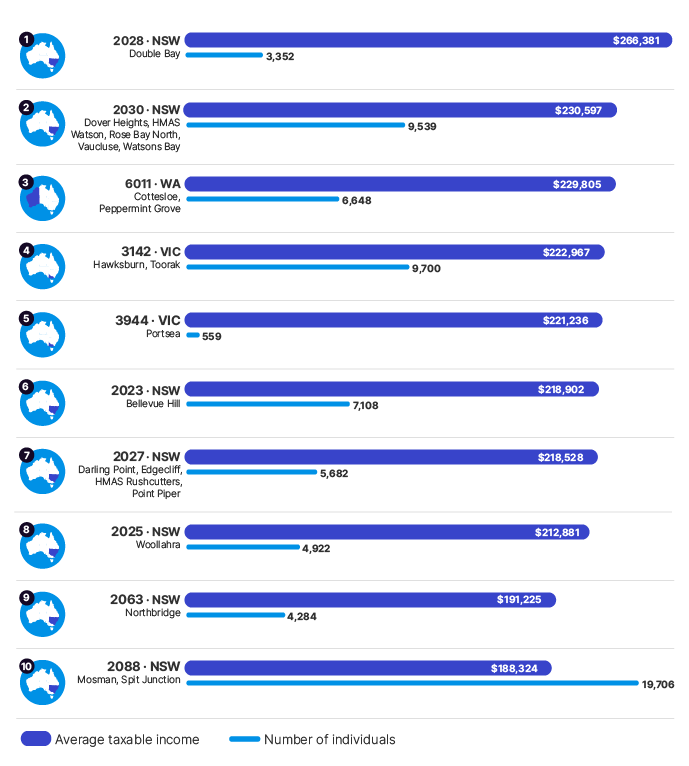

The ATO also has a list of the top 10 earning postcodes across Australia (according to average taxable income).

In 2020-21, some changes include Double Bay (2028) shooting to the top spot on the list and new suburbs like Portsea (3944) and Darling Point/Edgecliff/Rushcutters (2027).

Here’s the full list for you:

If all this talk about the highest-paying jobs is making you feel inspired to build on your financial literacy, take a peek at this list of money-focused books that should help. In addition to that, you can read up on the best ways to ask for a pay rise. Check that one out here.

And if you’re after a new gig, here are the jobs most in need of staff right now.

This article has been updated since its original publish date.

Leave a Reply

You must be logged in to post a comment.