Once I finally paid off my debt and generally got my financial life in order, I was ready to start investing. Everything I read told me to check out index funds, so I did. Sure enough, they’re pretty awesome tool with a handful of advantages for new and seasoned investors.

Illustration by Fruzsina Kuhári.

What Is an Index Fund?

You’ve probably heard the word fund before in the context of investing. There’s the complicated, official definition, but in basic, what-you-need-to-know terms, a fund is simply a group of smaller investments you buy in a single package. Depending on the type of fund, those smaller investments might be big companies like Google, Apple or Microsoft. They might be government bonds. Either way, a fund is one big investment made up of smaller assets. It’s sort of like buying an entire compilation album of your favourite artists instead of purchasing each track separately, one at a time.

An index fund is a fund that mirrors a certain index, and an index is just a measure of a financial market. For example, you’ve probably heard of the S&P 500. It’s an index that measures 500 of the most economically powerful companies in the United States. It would be a nightmare to buy and sell the right amount of stock in each of those individual companies on your own. Or worse, research your own companies from scratch. Who has time for that? Index funds do all of that work for you, you just buy a single investment. If the index does well, the index fund does well. If the index drops, so then does the index fund. And that’s why everyone loves them: The research is done for you, and so is the picking. (Its Australian equivalent is the S&P/ASX 200.)

There are a ton of different indices, and here are some of the most common ones. Firms like Vanguard and Fidelity have designed different index funds for all of these indices.

If the index is up, you can expect the matching index fund to be up. If the index plummets, so will the index fund. Historically, the S&P averages 10 per cent (before inflation) every year. So it’s no surprise that the following US index fund VFINX has a similar return.

Index Funds Are Awesome for Long-Term Investing

Index funds have a few advantages that make them great for long-term investing:

- Diversification

- Simplified, reliable performance

- Low fees

Each of these advantages are key to a solid “set and forget” investment portfolio.

Diversification

Diversification is hugely important when it comes to investing. You’ve probably heard the saying, “don’t put all your eggs in one basket.” In money terms, this translates to: Don’t invest all of your money in a single company, asset or asset class.

For example, Google is a solid, steady investment. However, you still don’t want to invest every single dollar you have into Google. Despite how secure the company is today, it’s dangerous to bet on Google and only Google to fund your retirement. You’re at the mercy of anything that could go wrong with one company. If they decide to use their every dollar to revive Google+, you’d get a little worried. Long story short: If something goes wrong, you lose everything and you’re entirely screwed.

On the other hand, if you’re invested in a bunch of other assets, too, you’re still OK if Google somehow tanks. That’s diversification in a nutshell, and that’s how index funds work. You’re investing in hundreds or thousands of different assets, whether those are company stocks or government bonds. In short: Index funds have built-in diversification. The banks and organisations that set the index specifically choose companies with diversification in mind.

Simplified, Reliable Performance

With an index fund, you’re making a simplified bet on a reliable index, like the S&P 500. Sure, that index has its ups and downs, but over time, it’s averaged a six to seven per cent return after inflation. That’s pretty good for long-term investing: Namely, saving for your retirement.

Here’s how J.D. Roth puts it over at Get Rich Slowly:

Do index funds always come out ahead in a given year? Not at all. In fact, they’re usually in the middle of the pack. By definition, index funds produce an average market return — no more, and no less.

However, over the long term — ten years, or twenty, or thirty — a remarkable thing happens. Index funds float to the top. It turns out that average performance in the short term is actually above average in the long term.

In short, index funds are meant to be steady and boring. They’re not going to skyrocket and make you rich overnight, but nothing will, and these are a pretty safe bet over time.

Low Fees

With other funds, an adviser or investor picks and chooses your individual investments. He or she keeps a close eye on them, then buys and sells those individual investments according to their performance. They want to beat that average six to seven per cent return by actively managing your fund. We call this active investing, and you pay for the work that goes into this.

When you buy a fund, you pay an expense ratio no matter what, and this is a fee that includes all the expenses the fund incurs. With active investing, this ratio includes a higher management fee for the extra time and effort.

On the other hand, because index funds are designed to simply mirror an index, they don’t require much maintenance at all. Again, if the index does well, your index fund does well. If the index drops, your index fund drops. We call this “set and forget” investing, or passive investing. There’s no maintenance involved, so the fees are much lower.

This study from Morningstar found that, over time, index funds outperform actively managed funds. Active investors question these studies, but one thing is certain: Index funds are generally cheaper than actively managed funds, and this can make a big difference in your return over time. Depending on the fund, active funds might very well beat the market, but you’ll pay a price for that. Sometimes it’s worth it, but you know what you’re getting with index funds: Low fees.

Now the downside: Most index funds have a pretty high buy-in limit. It can be several thousand dollars. It’s a lot, I know. Consider that you’re investing in thousands of different assets at once, though — that costs money. If you want to start investing with index funds and you don’t have enough saved, you’ll have to save enough in your investment account until you reach that number. Once you do, it’s time to think about picking and buying your fund.

How to Pick an Index Fund

Before you choose your index funds, you need to know your asset allocation so you know what index to invest in. And you need an investment account to actually purchase the fund.

A solid investment portfolio is well balanced in two basic asset categories: Stocks and bonds. Figuring out your asset allocation depends on your risk tolerance and how long until you need the money (usually, that means retirement). As a general rule of thumb:

110 – your age = the percentage of your portfolio that should be stocks

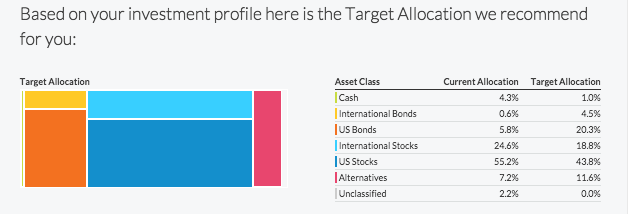

That just covers the very basics, though. In order to buy your index funds, you need to know what specific asset classes to buy into: International stocks or Australian bonds, for example. A tool like Personal Capital‘s portfolio checkup or Bankrate’s Asset Allocation calculator can help you figure it out. For example, here’s my target asset allocation, according to Personal Capital (I’m American, so it lists US stocks):

Once you know your asset allocation, picking your index fund is fairly easy. You just have to search for specific fund names that fall under the asset class you need. (If that sounds like too much work, you can always pick a lazy portfolio with pre-selected fund suggestions.) Here’s how this works.

First, look at the “Asset Class” category in the above example. This tells me the general classes I need to invest in: International Stocks, US Stocks and International Bonds. Let’s focus on picking index funds for US Stocks.

To find funds for this class or category, I need to look up a list of index funds at my brokerage firm. I use Vanguard, and here’s Vanguard’s US list of stock funds. From there, I simply run a search for the index fund(s) that fall under the class I need, which again, is US Stocks. Here they are:

There are a few different indices that fall under that class: Large-cap, small-cap, and so on. The more you learn about investing, the more precise your portfolio might be in each of these sub-categories. But for now, you just need one or two basics to get started. In my scenario, I picked the index funds VTSAX and VFIAX. Once I had these specific funds in mind, I researched a couple of important things.

For one, make sure your expense ratio is nice and low. And it should be, if it’s an index fund. According to the Motley Fool, a typical index fund expense ratio is around 0.25 per cent. As you can see in the above example, only one of these hits 0.10 per cent. Vanguard’s expense ratios are notoriously low.

Also, make sure the fund actually tracks its index. Compare the performance history of the fund with the index it tracks. They should be pretty parallel. For example, here’s how close VFIAX is to the S&P 500:

Once you’ve picked and researched your find, it’s time to actually buy it. Navigate to “buy” from your investment account, and enter the necessary information. It will probably ask you where the money will come from (your bank or other investment account) and what you want to buy (the index fund name). You could also just call your brokerage firm and tell them how much of which funds you want to buy.

Index funds are the ideal solution to building your own easy investment portfolio. Yes, you’ll want to rebalance your portfolio every now and then, and yes, it takes some startup cash, but in general, this is hands-off investing at its best. You can expect some ups and downs, but over time, you’ll see your investments have grown into a nice little nest egg.

Comments

One response to “How Index Funds Make Investing Easier And Less Scary”

“Most index funds have a pretty high buy-in limit.” If you’re just starting, consider Exchange Traded Funds (ETFs) .

Listed on the ASX, you buy these just like ordinary shares. Look at Etrade or Commsec, you should be able to buy as low as $500 (plus a fee).

As the previous comment indicated ETFs are a great way to get started in increasing (either within the super environment or not). However, I find the method to determine your asset allocation horrendous. Each individual has their own tolerance to risk (potential portfolio losses).

I personally would consider a combination of active and passive funds to be an ideal methology, but best to speak to a qualified financial adviser before commiting.