Every year on June 1, indexation is applied to all HECS HELP debts (and other study or training debts) across Australia.

In the simplest terms, this means that your HECS loan debt is adjusted to match the state of the cost of living by aligning it to the Consumer Price Index (CPI) or the inflation rate, as it is defined by the Australian Bureau of Statistics (ABS).

In April 2023, the ABS revealed its March quarter Consumer Price Index for Australia and set it at 7 per cent for the 2022-2023 period.

What does the June 1 indexation mean for my HECS HELP debt?

Well, the long and short of it is that the amount of money you owe will go up.

As of June 1, any unpaid debts you may have under the HECS HELP scheme or the VET Student Loan (VSL), Student Financial Supplement Scheme (SFSS), Student Start-up Loan (SSL), ABSTUDY Student Start-up Loan (ABSTUDY SSL) or Trade Support Loan (TSL), will be adjusted by 7 per cent.

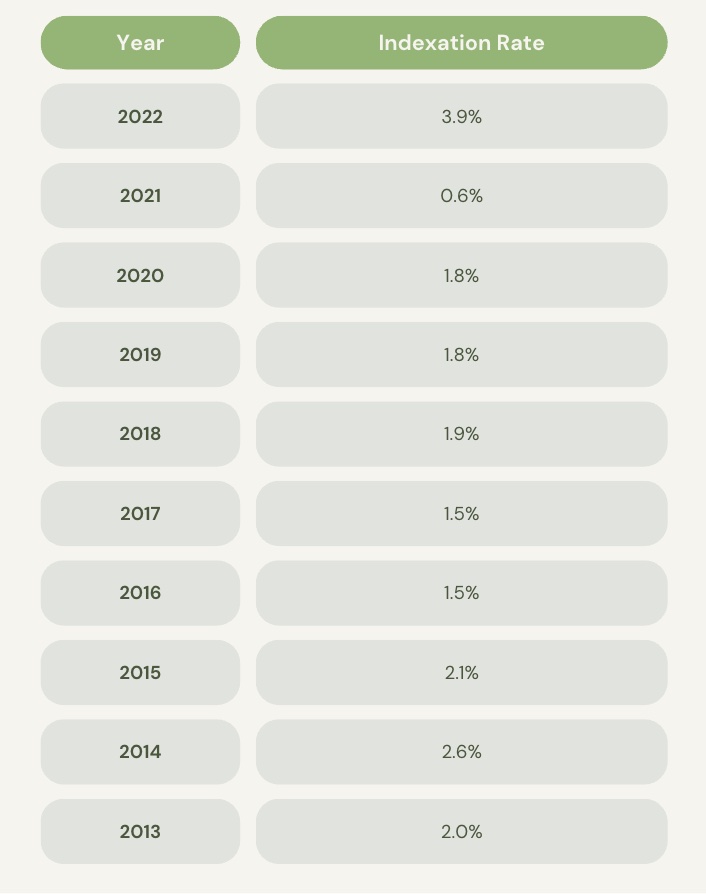

Here’s a look at how the rate has changed in recent years, according to the ATO.

How can I see how much I currently owe?

If all this chat about HECS HELP and study debt has you wondering how much money you currently owe, here’s a quick guide to help you find out.

First of all, it’s worth noting that repayment income thresholds mean compulsory payments do not kick in for HECS debt until you earn $48,361 and over. Once your income hits that value, repayments will begin.

You can check on your HECS HELP debt in a couple of ways. The simplest is online via your myGov account – it will need to be linked to the ATO, however.

- Once you’re logged in, head to ‘Linked Services‘

- Click on the ATO menu item

- Under ‘Loan Accounts: Accounts and balances‘, you’ll see a ‘View‘ button – click this to view your loan amount.

Alternatively, you can contact the ATO directly on 13 28 66.

What else should I know about my HECS HELP debt?

The amount you owe is adjusted every year. This year we’re hearing a lot more about this, however, because of the ridiculous increases we’re seeing in the cost of living and the corresponding indexation rate that’s being applied to loans.

If you are finding your repayments are causing you financial distress, there is the option to apply to deter your HECS HELP repayments temporarily.

You can learn more about the details of the study loan here.

Leave a Reply

You must be logged in to post a comment.