Everyone has money on the brain right now, and with the arrival of the 2023 federal budget, there is increased interest placed on the ways in which everyday Aussies can save. One point of interest, in particular, is the stage three tax cuts set to land in July 2024.

If you’re wondering how these tax cuts are set to work, here’s a quick and simple guide.

Stage three tax cuts are coming: here’s the deal

If you’ve been hearing a lot of talk about ‘stage three tax cuts’ of late, but aren’t exactly sure what they entail, allow us to offer an explanation.

In short, the tax cuts are set to abolish the current 37 per cent tax bracket and shift other tax brackets around, mostly benefiting high-income earners.

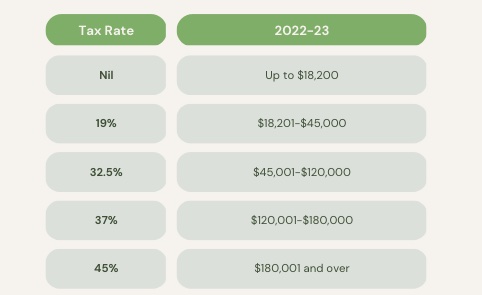

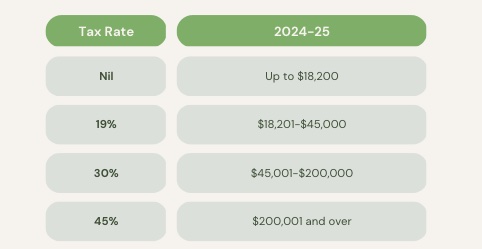

This is how the rates are changing, and for who:

As you can see from the tables above, things remain the same for folks earning up to $45,000. As soon as you hit $45,001, however, the figures begin to change.

If you’re someone who earns between $45,001 and $200,000, your tax rate will sit at 30 per cent come July 2024. This is down from 32.5 per cent for folks between $45,001 and $120,000, down from 37 per cent for those earning $120,001 to $180,000 and down from a whopping 45 per cent for those earning between $180,001 and over.

Obviously, this is a much (much, much) bigger win for people earning $120,001 and above. Their tax rates are as much as 15 per cent less if they’re in the higher bracket of this new range.

It’s worth noting here, as the ABC has done, that these tax rates do not necessarily mean folks in the highest bracket will be paying $0.45 on every dollar they earn.

The way it works is your earnings are broken down and taxed in line with the different rates, but only the money you earn over each bracket is taxed at that specific rate.

For example: Per the ATO, under the 2022/23 rates, anyone earning between $18,201 – $45,000 would be taxed 19 per cent or $0.19 on every dollar for any income earned that is over $18,200. This continues for every tax bracket that follows. You can see the full breakdown via the ATO here.

Want more tax advice ahead of the EOFY? Check out all our biggest tips here.

Leave a Reply

You must be logged in to post a comment.