Money is a stressful topic for many people. That’s been the case for a long time, and financial circumstances are only worsening for folks across Australia right now. While there is little we can do to change the external situations influencing Australian bank balances right now, we can take a look at ways to better manage stress when it comes to money.

According to mindfulness and meditation app Headspace, stress is a fairly ubiquitous issue for Australians right now with as much as “91 per cent of working Australians reporting experiencing moderate to extreme stress at least once a week. [And] Almost half experience stress most days”.

While there are loads of possible reasons for that statistic, one clear stand out right now is money and the rising cost of living. The price of everything from lettuce to power bills is increasing, and it’s becoming harder to make ends meet. That takes its toll on our well-being.

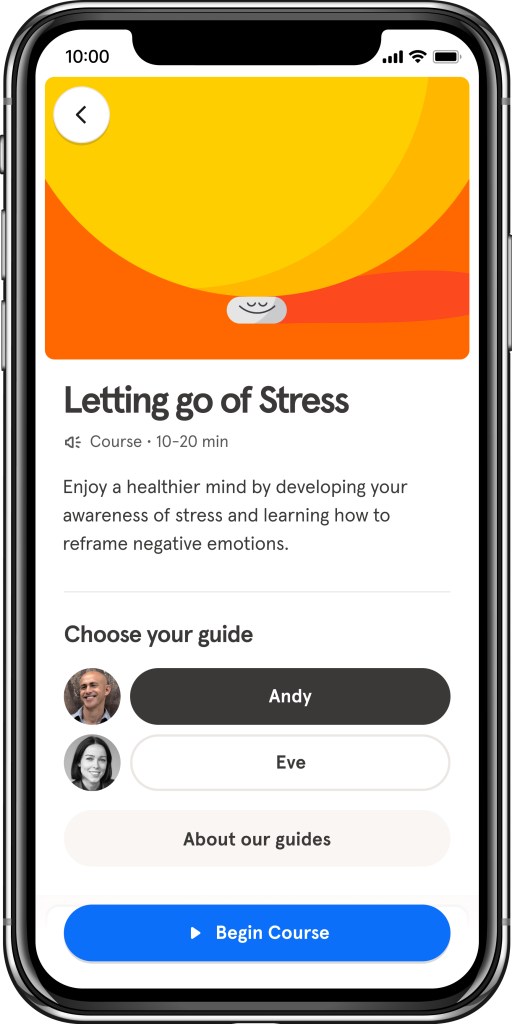

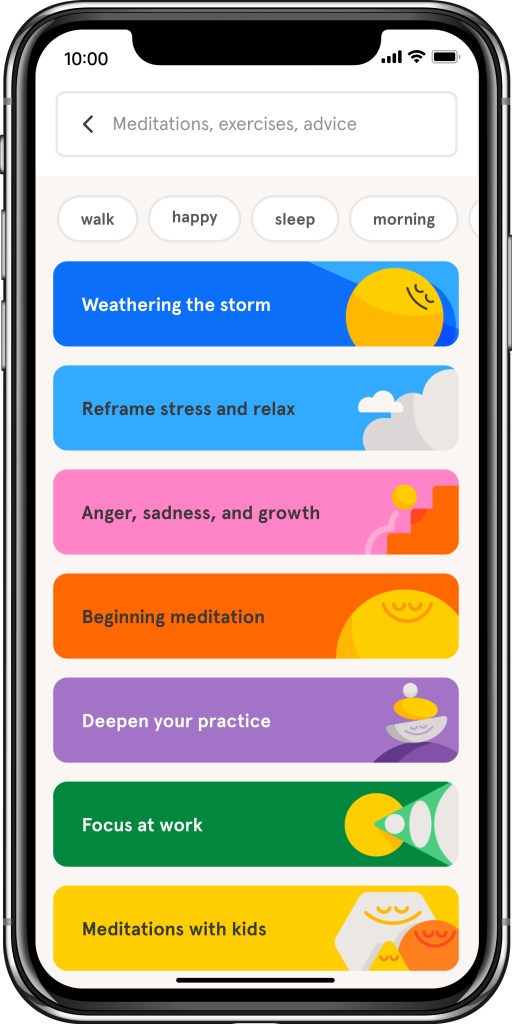

If that sounds familiar to you, we’d like to turn your attention to the benefits of mindfulness and meditation for managing financial stress. Now, of course, if you have found yourself in an incredibly difficult financial bind, your best bet is to speak to a financial expert who can offer tailored advice. But, when it comes to adopting healthy habits around money and maybe removing some of the stress from the topic, Headspace has some options.

Reducing money stress with mindfulness

Headspace has a handful of audio offerings regarding money and stress management, ranging from five-minute guided sessions to 10-part courses. They’re run by financial wellness expert Alex Holder and financial education expert and entrepreneur Tonya Rapley, and they each gently walk folks through tips that can help you feel more in control when it comes to money.

What you can expect to learn

- Confronting Debt: This five-minute guidance works to help you feel more empowered in your relationship with money and offers strategies around managing debt and getting out of it.

- Budgeting Basics: If you’re stressed about money and don’t know where to begin, this guide will take you through the absolute basics regarding moving away from paycheck-to-paycheck living. From tips on the best way to record your spending habits, to how often you should cross-check your budget, it’s the perfect starting point.

- How to Talk About Money: Money can be seen as a taboo topic and that is something we need to shift. This audio guide will walk you through how to become better at talking about money and how that can lead to healthier relationships and less stress, too.

- Managing Financial Stress: For those looking for a more in-depth look at money and stress management, there is a 10-part course dedicated to precisely that. Touching on everything from learning to have more patience with money issues to mindful spending, it’s a well-rounded look at improving your headspace around finance.

Does mindfulness really help with stress?

According to data shared by Headspace, yeah it really can. The mindfulness and meditation app reports that users of the service have recorded a 32 per cent decrease in stress after 30 days and a 31 per cent decrease in anxiety symptoms after eight weeks.

But more than that, it’s also valuable to walk away with tools that you can apply towards managing money stress a little better for years to come.

Rapley put it this way in one of her guidance sessions:

“Budgeting might seem like a daunting task, but once you sit down and start you’ll see facing the reality of your finances is much better than letting your worst fears run wild. It won’t give you the bank account balance you want overnight, but it’s the first step to getting more control over your money and creating a foundational practice that will eventually help you plan for the future.”

Pretty useful, no?

Learn more about the benefits of mindfulness and meditation with Headspace here.

Leave a Reply

You must be logged in to post a comment.