We’re nearing the end of July and by now, many of us would have begrudgingly gotten our tax returns done. For the curious few out there, the tax office actually provides a breakdown of where your precious tax money is going and what it’s contributing to.

Taxation, and the distribution of it to crucial services, is a necessary policy for any flourishing society but it’s one a lot Australians tend to bemoan. After a hard week, fortnight or month of work, a certain amount of income is deducted and sent to the government.

It’s meant those who rely on government support payments have become the easy target of conservative columnists looking to channel frustration.

A good way to counteract that fallacy is by telling tax payers directly where their taxes are going to. The Australian Tax Office (ATO) is doing just that.

After someone completes a tax return, the ATO delivers a tax receipt to their inbox stating which sectors your tax amount has gone to.

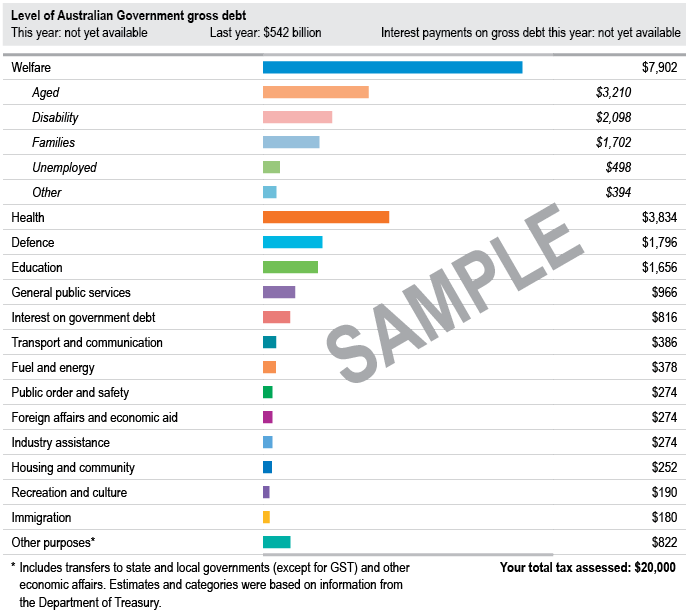

These areas can include welfare, which is broken down into aged, disability, families and unemployed, as well as other sectors such as health, defence, education and transport.

“The Australian Government thanks you for your tax contribution for 2019-20. This statement details Australian Government debt levels and where your personal income tax would be spent, based on the 2019-20 Budget,” the tax receipt outlines.

“Please note that these figures do not reflect recently announced stimulus measures or new debt levels, which will be reflected in the 2020-21 Budget.”

It’s by no means a new thing — the process was first introduced by the tax office back in 2014 for greater transparency and a bit of casual political point scoring.

Either way, it’s definitely worthwhile if you’ve always been curious about how your tax money is being spent.

Leave a Reply

You must be logged in to post a comment.