If you’re struggling with paying off credit cards or loans, the “Snowball Method” gives you a way to pay each debt, then roll what you would have paid into payments for next account once each is paid off. It’s a fast and predictable way to get out of debt, and this calculator makes it easy.

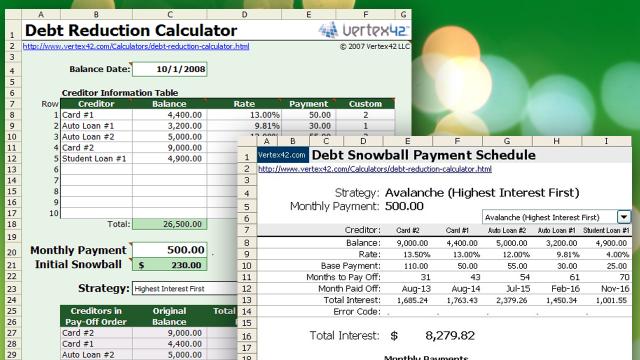

The calculator comes in in the form of a downloadable Microsoft Excel template that you can add to Excel 2003 or later. Once you’ve opened it up, enter each of your credit cards, loans or other debts into each row, along with their outstanding balances, interest rates, and how much you can afford to put to each debt every month (at least the minimum payment). Then select whether you want to pay the highest interest first or the highest balance first, and the calculator will tell you how much to put where. You’ll even get a graph that shows you how long it will take to get out of debt completely.

The best thing about the snowball method is that you can tweak it to fit the way you want to pay down your debts. Whether you prefer the mathematically sound method of paying in order of interest (which most people prefer, because you wind up paying less in interest over time) or you choose to pay in order of balance (you wind up paying more over time, but some people report feeling more accomplished and motivated this way), the spreadsheet is useful. Hit the link below to download it.

Debt Reduction Snowball Calculator [Vertex42 via Cool Tools]

Comments