Managing a dual-income household can be a difficult task, especially since the average couple maintains 16 different financial accounts, according to Eugene Park, creator of Honeydue, an app that helps couples budget. But there are a bunch of tech options available to help make the process easier – and every couple has different needs.

The most important part of budgeting as a couple is transparency: Each person needs to know what’s going on with the finances, and one person should not shoulder all of the financial responsibility. This doesn’t mean that you need to know what your partner does with every single cent, but you should have an idea of his or her balances, and you should have a frank conversation about bills and who pays for what.

“Decide how to divvy up tasks such as paying bills, managing investments, or arranging appointments with your financial professional,” Marcy Keckler, VP of Financial Advice Strategy at Ameriprise Financial. “Consider establishing a joint banking account for shared expenses and individual accounts for personal purchases. This approach allows you to pay bills with ease, while giving each person the freedom to spend money on their own terms.”

Check out this post for more information on that:

It’s true that Mint (and most individualized money apps) are not great for multiple users. That’s Park advises each individual in the relationship to manage their own finances with their preferred app (like Mint or Clarity Money), and then use an app like Honeydue to see joint accounts and set bill reminders. After you decide how you’re splitting up the bills, automate as many as possible.

An added benefit of Honeydue is that each person shares only the information that they are comfortable sharing. You choose the accounts (say a joint account or your individual checking or savings accounts) and whether you only want to share the balance or the actual transactions as well. You can also ask your partner about individual charges.

Another option is the good old-fashioned budget spreadsheet, which is helpful because it’s collaborative and easily-accessible to all parties. Peter Polson, founder of Tiller Money, a paid service that provides premade budget sheets, suggests this setup for couples new to budgeting together:

- Partner 1 income

- Partner 2 income

- Partner 1 expenses

- Partner 2 expenses

- Shared expenses paid by partner 1

- Shared expenses paid by partner 2

“Both partners see everything,” says Polson. “When they talk about money periodically, they can focus on the shared expenses: Are we making the right shared expenses? Is the balance right between the two of us?”

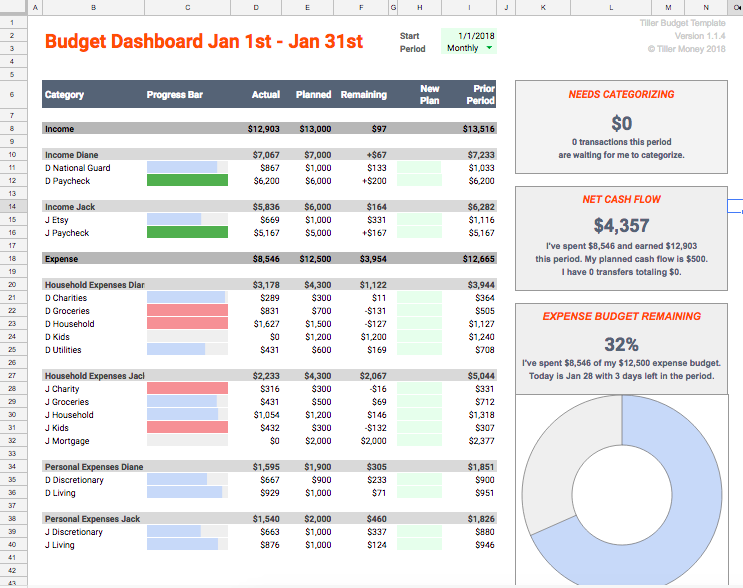

You can build your own, using the outline above as a model, or check out a product like Tiller. Like a budgeting app, it uploads your financial data each day, so you can get a sense of your habits in addition to seeing your and your partner’s budget. Here’s a sample budget that Tiller created:

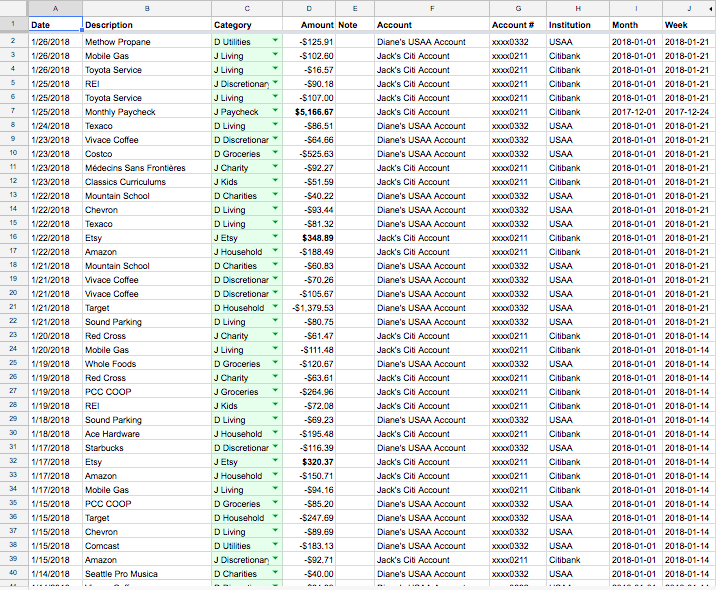

And a more in-depth breakdown:

The point is that it’s flexible: You can create your own budget sheets, or use Tiller’s templates. How you structure them and what categories you designate is up to you and your partner.

Once you’ve kept a spreadsheet for a few months or used an app to track spending patterns and bill pay, you’ll be able to spot opportunities to save or invest some money. Again, have an honest conversation with your partner (maybe with a little wine) and talk about your options.

“If the couple finds they have too much cash in a joint account with an anemic rate of interest, it’s an opportunity to establish an emergency savings account to build up enough money to last for three to six months of expenses, if they haven’t already,” says Paul Bennett, a certified financial planner and author of The Money Navigator.

“Once this is established, a long-term investment program can be started. Otherwise, you’re sitting on money and your purchasing power is getting eroded.”

If you’re working towards a shared financial goal (say, saving for a vacation or a new couch), try apps like Digit or Simple – they’re meant for individuals, but share a login and it becomes easy to track.

You can use an app, spreadsheets, or some combination of the two — whatever you find works best for you.

Comments