Used to be, you’d sit down once a month with your bank statement, receipts and check register, and make sure all of your deposits and withdrawals lined up.

It was a simpler time, before online fraud was rampant and apps like Mint made budgeting sort of easier – or at least, apps made it easier to track your spending. Now, banks make fewer errors, most transactions are instantaneous and we have access to our account balance and a list of transactions at pretty much any time. Balancing a checkbook? Who needs to in 2018.

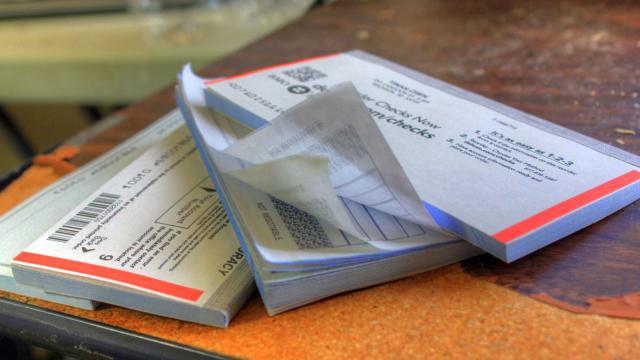

That said, we should still check (no pun intended) in with our accounts to make sure everything’s in order and we’re not getting scammed or charged overdraft fees. Personally, I get text updates and check my bank statements each month, and that’s about it. I have a checkbook but I rarely use it. If I do, it’s for rent or because I owe family members – who shall remain nameless but refuse to download P2P apps – money. Never mind a check register.

So, do you balance your checkbook? And if not, what system do you use to verify your financial accounts?

Comments