Super hurricane Irma is causing a ton of cruise and flight cancellations in addition to delays and course changes. But your travel insurance should cover all that, right? Maybe. Maybe not.

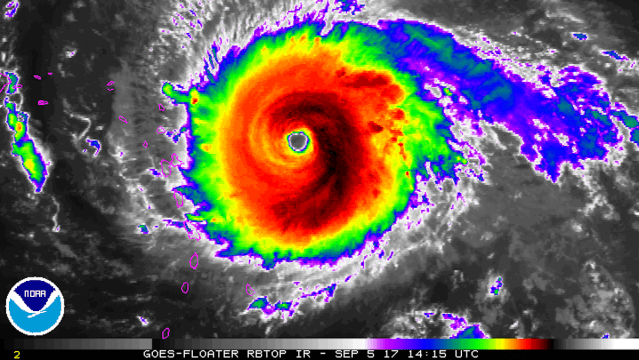

Image via NOAA.

What Your Travel Insurance May Cover

Depending on what kind of coverage you get from your chosen provider, travel insurance can cover a wide array of things during a super storm, including:

- Trip cancellation or shortening

- Lengthy delays that require hotels and meals

- Injury and medical transportation

The thing is, every policy is different, so you have to check what you got covered when you bought it. If you have trip cancellation coverage (which will be specified in your policy), you can be reimbursed for the entire cruise, flight or holiday as long as certain requirements are met.

For example, you can’t just cancel your trip because you see a hurricane may be in your trip’s path and expect to be reimbursed. The cruise line, airline or tour must cancel the trip themselves, or be forced to shut down operation for at least 24 hours. Only then will your insurance provider reimburse you for non-refundable travel costs. You also can’t cancel your trip if your cruise, airline or tour is forced to change course due to the storm. As long as they offer an alternative itinerary with the same value as your original trip, you have to go along with the changes.

So you can cancel your trip if they cancel, but when else? It depends. If your destination gets devastated by a storm and becomes “uninhabitable”, or there’s a mandatory evacuation issued for the area, you can cancel then too. If you have trip interruption coverage, the same goes for any interruptions caused by a storm unexpectedly changing course and hitting the destination you’re in, or if one hits your home while you’re away, forcing you to stay at your destination longer.

Don’t be too quick to cancel your flights or other travel plans, however. For most travel insurance you have to lose more than 50 per cent of your scheduled trip due to a weather-related travel delay before you can make a claim. Make what they call a “good-faith effort to continue your travels” before you cancel anything. And make sure you hold onto copies of your trip itinerary and any statements from airlines, cruise lines or tour operators.

What’s In a Name?

With the right policy, travel insurance can save you a lot of grief during hurricane season, but there’s a catch. When it comes to big storms such as Irma, you need to have acquired your travel insurance policy before the storm is named.

Travel insurance is protection for “unforeseen situations and events”, and a storm that’s been watched long enough to be given an official name is considered a “foreseeable event”. If you bought travel insurance for your trip after the naming — which in this case was August 30 — your plan will not cover any storm-related claims.

Know What to Get and When to Get It in the Future

Hurricane season is between June 1 and November 30, so if you’re travelling in the Atlantic region during those months, especially the Gulf Coast and Caribbean, you should probably have travel insurance with coverage for hurricanes. When you purchase your policy, make sure it covers travel delays, medical evacuations, trip interruptions and trip cancellations. Also, make extra sure your policy lists hurricanes as natural disasters or extreme weather.

Comments