Taking money advice from a loan servicer is sort of like taking health advice from a tobacco company. The advice might be valid, but there’s probably a better source out there for you. Namely, one that doesn’t profit from your bad habits.

The Consumer Financial Protection Bureau (CFPB) recently sued Navient, a student loan servicer, for a handful of shady business practices, like misapplying student loan payments and misreporting information to credit bureaus. If that’s not bad enough, they reportedly also misled borrowers with questionable advice on their relief options.

So how did Navient, a company whose Financial Tips blog touts that their mission is to “help student loan borrowers navigate the path to financial success,” respond to the lawsuit? Here’s what they had to say:

There is no expectation that the servicer will act in the interest of the consumer.

Guilty or not, this response is kind of a slap in the face to borrowers, and while this example occurred in the US, this type of marketing exists in Australia too.

How Companies Hook You With Big Ideas

Navient’s defence is that they’re not here to help, but that’s a contradictory message to the one on their website, which urges readers to visit often for “the latest tips and strategies you can use to help achieve your goals.”

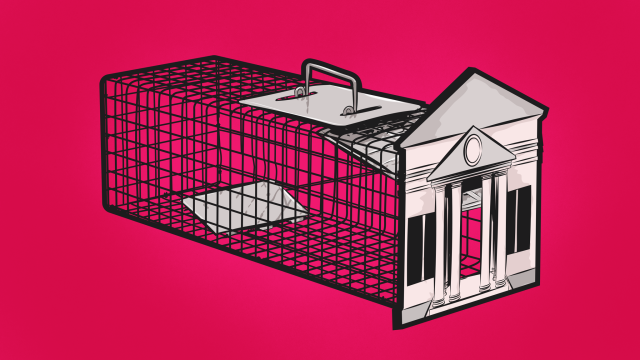

The Navient fiasco highlights the problem with a popular business trend: big idea marketing.

You’ve encountered big idea marketing in some form. It’s when companies try to hook consumers with an idea that’s bigger than the actual product they’re selling. You’re not just buying a phone, you’re a trailblazing rebel. You’re not just buying shoes, you’re improving lives. Big idea marketing isn’t always a bad thing, though. Helping someone in need is a big idea, and it’s a good idea!

But big idea marketing can become problematic when the idea contradicts the way the company profits, like when predatory financial services promote financial literacy. You’re not in debt and accruing massive interest, you’re navigating the path to financial success!

When Money Advice Becomes a Marketing Plan, It’s Problematic

Navient certainly isn’t the only example of this. A while back, writer J.Money of the popular finance blog Budgets Are Sexy complained about a media pitch he received from a credit card bank who wanted to encourage Millennials to use credit cards more often:

When asked what is the biggest benefit of using cash, most Millennials said using cash ensures they spend within their means and one-fifth say they worry using a credit card will make them incur debt. However, strategically using credit for regular purchases can help Millennials keep track of their overall budget.

J.Money’s response to this pitch summed up my own thoughts pretty well:

COME ON!!!! If people are worried about going into debt AND spending within their means, then leave them alone already! They’re being smarter than most other adults out there! Who cares about the rewards if you’re just going to dig yourself into a hole in the end and pay more for the privilege of it.

Sure, using a credit card can help your credit if you do it responsibly, but solid money habits are more important than good credit. Also? Credit card companies actually profit when you don’t use cards responsibly. They profit when you fail, financially speaking.

And that’s the problem right there: the advice is not completely wrong. These companies aren’t exactly misinforming consumers, they’re manipulating them by baiting them with a little bit of truth.

The line gets blurry. For example, while J.Money’s example is fairly obvious, the fact that these companies reach out to bloggers, personal finance experts, and journalists to spread their message just goes to show that there’s a fine line between solid advice and marketing.

How to Protect Yourself

So how do you protect yourself from big idea marketing masquerading as money advice?

For one, you can think like a journalist. A journalist has to consider the source and avoid those pesky conflicts of interest. Similarly, when you come across a bit of financial advice, whether it’s a blog post or a quote, it might help to consider your source. How does the source get paid? Is it a podcaster who gets paid via ads? Good financial advice doesn’t exactly contradict the way she profits (in fact, it supports her success). On the other hand, if it’s a credit card company that gets paid when you go into debt, good financial advice totally contradicts the way they profit. This doesn’t necessarily make the financial advice good or bad either way, but conflicts of interest are certainly worth considering.

You can also research the company’s reputation. The CFPB’s massive consumer complaint database contains a number of different banks, credit unions, and other financial services customers have lodged complaints against. In Australia, you could look at the ACCC, Choice, or even just good ol’ Dr Google. Let’s say you’re hooked on a blog, podcast, or video series but it’s sponsored by a major bank or investment firm. Again, that doesn’t automatically make the advice wrong, but the least you can do is research that entity’s reputation.

It should go without saying that you should verify any advice, too.

Finally, if you’re getting advice from a financial planner, you definitely want to make sure they’re certified. Certified planners have to take a fiduciary oath to give advice that’s actually in your best interest. The alternative is working with someone who’s just trying to sell you an investment product, even if it’s not the best fit for your portfolio.

Personal finance isn’t nearly as complicated as people think. It’s great that there are so many blogs, books, videos, and podcasts out there that make financial literacy more accessible for people. The drawback is that this advice is so accessible that you have to be careful about where you access it. Advice from a loan servicer might not be outrightly wrong, but don’t expect them to act in your best interest, even if their blog suggests otherwise.

Comments

3 responses to “Don’t Take Money Advice From Companies That Profit When You Fail”

Being on the 30th floor of a building overlooking Sydney Harbour should be a clue as to who your advisor is looking out for…

like seeing a audiologist who tests your hearing and sells hearing aids, of course your hearing will deteriorate by 10% every time you see them.

Be skeptical of information from *every* person who stands to gain from your belief.