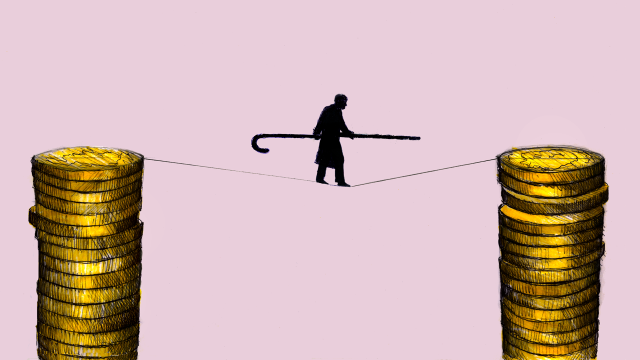

Going down a path toward retiring early, whether you’re in the middle of your career and looking to just shave a few years off or you’re early in your career and looking to shave off a decade or two, is like running a very long footrace on uneven ground. You can see that amazing finish line in your head, but there’s a lot of ground to cover first and some real potential for something unexpected to happen.

This post originally appeared on The Simple Dollar.

Almost all financial success that we experience in life comes from thinking through the options carefully and making a smart decision. This is true from the small stuff, such as whether to buy store brand pasta or not, to the big stuff like, well, retiring early.

If the idea of spending below your income level throughout your career in exchange for the ability to retire early or increase your career options later is an appealing one to you — and it is very appealing to me — then I encourage you to think through these five key things very carefully.

1. Children Will Almost Definitely Delay Your Early Retirement

I would be “retired” right now if I did not have children. Because Sarah and I chose to have children, my “retirement” will probably come shortly after our youngest graduates from high school, and he’s in early elementary school.

That’s a pretty big change, but it reflects the reality and the expense of having children. I don’t regret the choice to have children, but I’m also not in denial about the financial impact they have had on our life.

Unless you’re neglectful, children come with a lot of expenses. You’re feeding and clothing and housing a child for eighteen years. You provide toiletries for that child, learning materials for that child, household supplies for that child, medical care for the child. You’re also likely to buy the child gifts and treats at various points.

There’s also the impact that having a child has on your career. You’re going to wind up taking time off for your child. Your child is going to devour spare time that you might have otherwise used on a side gig or on self improvement or on career advancement. Your child is also going to eat into your sleep time, especially when the child is young, but also during the teen years.

That’s not to say that having a child isn’t rewarding. It is very rewarding. However, those rewards are very personal in nature and don’t show up in a financial balance sheet.

If you’re considering having children — or already have children — and you’re also considering early retirement, you need to recognise that the presence of children will slow down your progress toward that goal. Take that into consideration when making either decision.

2. You Won’t Be “Keeping up With the Joneses”

If I look up and down the block we live on, virtually everyone has newer cars than we do. Our two vehicles are currently seven and thirteen years old and the oldest vehicle owned by any of our neighbours, by our best estimation, is also about seven years old. We drive the old cars on our block, in other words.

My children are close friends with a few kids on the block and they all have neat toys and gadgets that far outstrip what our own children have. The same goes for the adults in each house, too.

The thing is, I could get really worked up over this. I could feel jealous about it and want to buy a new car or a bunch of new gadgets to “keep up.”

But why? How does that really fulfil what I want out of life?

Even though I have that perspective, there are still times when I feel pangs of jealousy. I sometimes want to have all of the things that they have, even though I know in a broader sense that I am making the best choice for me in the long term.

You’ll have to deal with that contradiction constantly, and when you choose to “keep up with the Joneses” — or keep up with people in your social group or keep up with people in your online communities — you’re going to end up paying the price in terms of achieving your early retirement goals.

Buying things that you personally value is fine, but when that value is hyperinflated by a desire to “keep up,” it’s a purchase that ends up not having much lasting value. Mastering this idea is harder than it sounds, but it’s essential for early retirement.

3. You Have to Be Somewhat Selective in Your “Little Treats”

Many people fill their life with little treats, like stopping at a coffee shop to pick up a morning latte and a bagel or stopping at a bookstore regularly or stopping at a convenience store in the evening to pick up a six pack of beer.

Often, people consume far more “little treats” than they think they do. These little treats are often very forgettable, in that they’re low cost, consumed quickly (or just added to collections without a second thought), and then completely forgotten within an hour or two.

The catch is that the costs of these little treats add up, while at the same time the frequency and forgettability of these treats makes them essentially meaningless in terms of providing lasting pleasure. They provide a very small, very short term burst of pleasure in exchange for a chunk of your future.

The best solution is not to give up “treats,” but spread them out so that you also get joy out of the anticipation and they’re no longer forgettable. You can get almost as much joy out of a monthly visit to a coffee shop, for example, than you do out of a daily stop, because that monthly stop is a genuine treat and feels special.

Mastering that distinction and breaking away from the daily and weekly routines that center around little treats is a very big key in any financial turnaround, but many people choose to frame that change as utter misery. Without it, however, the resources you need for early retirement just flow right out of your pockets without building any kind of future for yourself and, at the same time, you’re sacrificing the anticipation and the “specialness” of many of the treats in your life.

It’s a difficult shift, but a necessary one.

4. You Will Be Criticised by People You Trust Who Think You’re Being a Fool

In fact, you’re probably better off just keeping your plans to yourself in mixed company, because you’ll almost always be greeted with disbelief and strange criticism when you mention your plans.

Most people simply don’t accept that early retirement is even possible for themselves or for someone at their approximate income level. You can’t possibly retire early if you’re living paycheck to paycheck. Also, many are saving for a normal retirement or even a slightly late retirement.

The idea that someone is doing something different is usually met with a pretty critical response, and you need to accept that you’re going to hear some criticism — most of it unfounded — if you choose this route. People will basically tell you that early retirement is impossible or imply that you must be living like a hermit when neither one is remotely true.

Don’t let such criticism bother you, but be aware that it will come. Know how to handle it politely. My typical response is that even if things don’t work out exactly like I want, I’m pretty happy with my life right now and I will have plenty for a traditional retirement.

5. You Need to Have a Plan for What to Do After You “Retire”

Let’s say you do retire early. You’re done working at, say, age 50 or so. What are you going to do then?

At that point, you have more than three decades left in your life, most of which should involve pretty good health. You suddenly have tons of free time. How will you fill it?

The reason for thinking about this question now rather than later is that, if you don’t have a good vision for this time, why are you retiring early? Without some kind of a plan for the years after retiring, it’s kind of fruitless to retire early.

For me, retirement is more of a tool to launch another career path, one that won’t necessarily earn a lot of money but will provide a lot of personal enjoyment. The day when I walk away from “work” isn’t a day when I become idle. It’s a day when I leap into new plans.

What are your plans? And, if you don’t have those plans, why are you retiring early?

Final Thoughts

Early retirement isn’t an easy path. It’s one that’s fraught with temptations and distractions and big questions about why you’re even doing this.

Thinking about those things early on, before they’re in the way of your progress, can make all the difference between success and failure.

Let these ideas be food for thought for you as you think about your own journey toward retirement, early or otherwise.

Five Key Things to Think About If You’re Considering a Path to Early Retirement [The Simple Dollar]

Trent Hamm is a personal finance writer at TheSimpleDollar.com. After pulling himself out of his own financial crisis, he founded the site in late 2006 to help others through financially difficult situations; today the site has become a finance, insurance, and retirement resource. Contact Trent at trent AT the simple dollar DOT com; please send site inquiries to inquiries AT the simple dollar DOT com.

Image by Gary Waters via Getty.

Comments