While tax time usually conjures the image of piles of paper and shoeboxes full of old receipts, it doesn’t have to be that way. If you’re sick of shuffling through hard copy documents to get your finances sorted every July, here are our top five apps that’ll save you time and stress as you work towards getting your tax return sorted this tax time.

(Note that this list is collated from online reviews, recommendations and popular opinion. We have not reviewed these products ourselves unless otherwise stated.)

Best tax apps to help you lodge your tax return

With so many of us working from home now there are more expenses and tax deductions to keep track of than ever before. If you don’t want to get caught out by the looming tax deadline we suggest you check out some of these apps to help keep your expenses in order all year round.

Australian Taxation Office app

Price: Free

Platforms: iOS, Android

The official app is mentioned first up because you can trust it to accurately reference the ATO’s rules and regulations.

The ATO’s official app has gone through a number of upgrades since it was first released. There’s a tool that lets you digitally keep track of your deductions throughout the year and then export them directly into your tax return. This myDeductions feature will also let you log car trips if you use your car for work.

It also has a number of tools and calculators, such as a tax withheld calculator and the ability to view your tax accounts (including your Higher Education Loan Program (HELP) balance and your upcoming lodgment and payment due dates.

While you’ll be redirected to the ATO’s myTax service to actually lodge your return, data entered into myDeductions will sync up, and you can even use this app after the fact to check the status of your tax return.

If you’re a small business owner, the ATO app has a couple of tools for you as well, such as a business performance check that’ll show you how your business matches up against its competitors in your industry.

Best of all, it’s free. Read more about it here.

Etax app

Price: Free to start, $70.90+ to lodge

Platforms: iOS, Android

Etax promises to help you lodge your tax return in just minutes.

The app is free to download and it’s also free to start your tax return. You only have to pay once when you want to lodge a return, with fees starting from $70.90. You can even opt to have your fee taken out of your return, as many do when handling their tax through an accountant.

Your tax return will be reviewed by a registered accountant before lodging.

The Etax app is largely designed to make the process of lodging easier. Questions are asked in plain English rather than tax-office jargon, and you’re even able to message an accountant if you need help. Like the ATO’s app, Etax also allows you to snap photos of your important documents to easily import them.

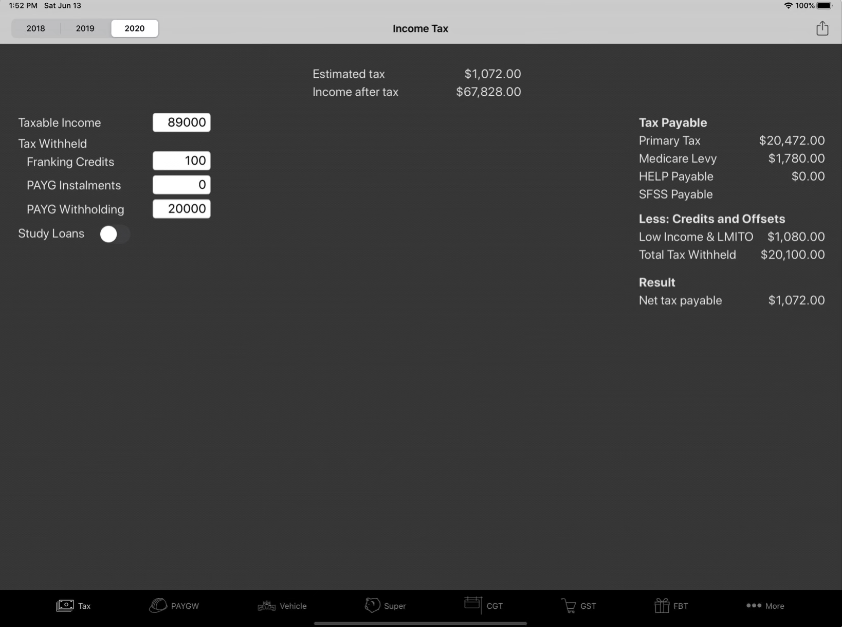

My Tax Calculator Australia app

Price: $12.99

While my Tax calculator (not to be confused with the government’s myTax tool) is a bit older, it’s still a great tool for tax time, developed by a chartered accountant.

The Mac OS version is only available for devices with an M1 chip, while the iPad and iPhone editions need at least iOS 12 or later. You’ll need to fork out $12.99 for either.

My Tax Calculator is a collection of tax calculators, which were last updated to include the ATO’s 2020 rates.

Its tools cover a huge range of tax-related areas, with everything from HELP debts to PAYG withholding to working out whether it’s in your best interest to salary sacrifice your superannuation. For investors, it also has a Capital Gains Tax calculator so that you can plan your next move with your shares, investment properties or other capital assets.

Squirrel Street tax app

Price: Monthly plans from $26.95

Platforms: Web, iOS

Formerly known as Shoeboxed, Squirrel Street is a quick and easy way to keep track of your receipts.

The core of the service allows you to send images of your documents to Squirrel Street, which will scan, verify and digitally store them. Don’t worry about the ATO with this one – the ATO will happily accept digital documents as well as physical ones.

Squirrel Street offers pricing plans that suit both individuals and businesses. Plans start at $27.95 a month for 50 documents and go up to $295.95 a month for 600 documents and a 1-day turnaround.

The app is a lot easier than most receipt-keeping apps, however. Squirrel Street will extract all the information from your receipts automatically – all you need to do is snap a picture.

Outside of tax time, you can even use this to keep track of expenses to be reimbursed by your workplace. If you already use accounting software, Squirrel Street is compatible with a number of them including MYOB, Xero, QuickBooks and more.

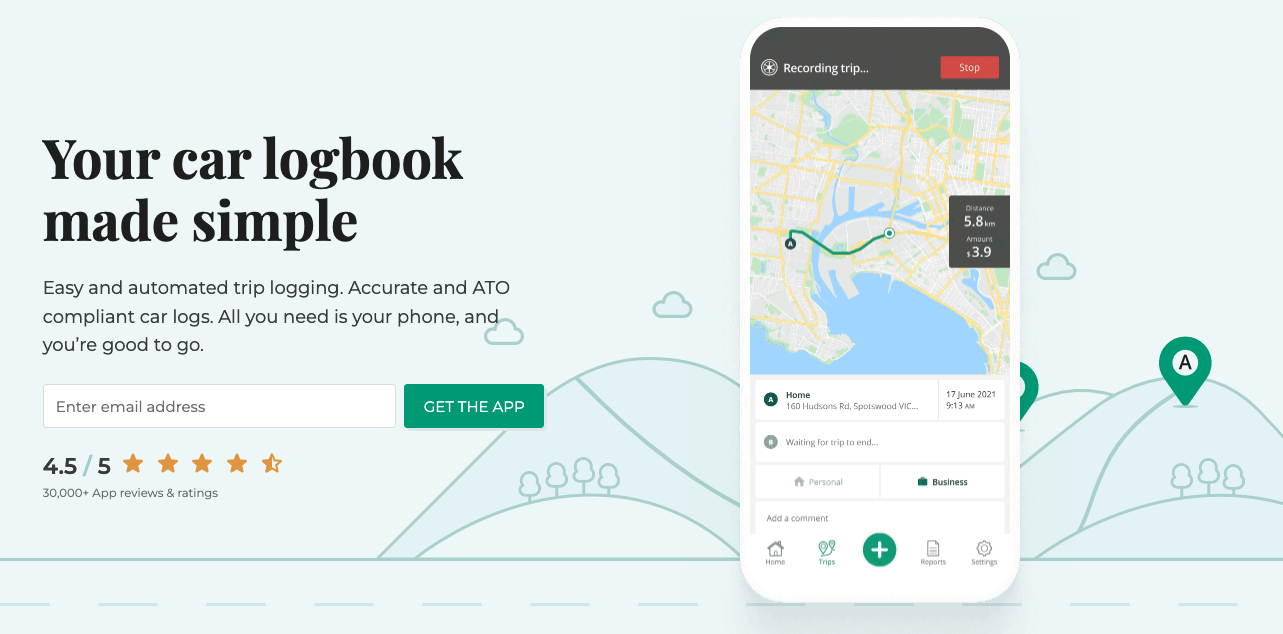

Mileage Logbook tax app

Price: Free

Platforms: iOS, Android

Mileage Logbook by Driversnote is an ATO compliant vehicle logbook app that tracks your trips and creates mileage documents for the hand-over at tax time.

The app tracks your trips through your GPS and will auto-log them when you’re done. It’s then easy to classify trips, name locations and split journeys between different employers.

When it’s time to log your documents, you can download them as PDF or Excel spreadsheets for handover to the ATO or your employer. You can also access the ATO’s mileage rates.

Lodging your tax return

When it comes time to lodging your actual tax return you might be looking for some more tips (beyond tax apps) on tax time for 2022. You can read more details on the ATO website or check out our guide to lodging your tax return for the first time.

This article has been updated with new apps since its original publication.

Comments