Falling oil prices mean cheaper petrol, and that makes most of us pretty happy. The average price for petrol in Australia is now $1.22 per litre, nearly $0.13 less than it was last April. Over time, though, cheap petrol isn’t always a good thing. It can have a big impact on the economy, and, in turn, your wallet.

Illustration by Sam Woolley.

Oil Is Cheap Because Supply Is High

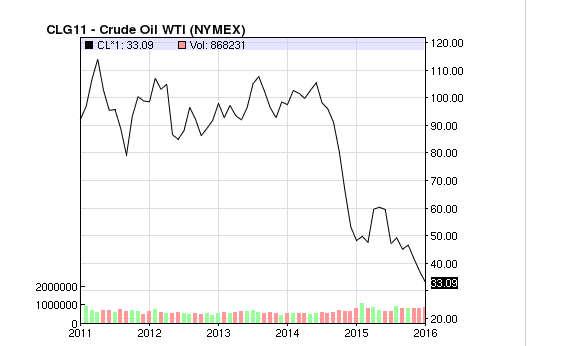

Oil prices have completely plummeted since 2014, and you can plainly see the drop here:

There are a number of complicated political factors that explain this drop, but at the core, it’s Economics 101: supply and demand.

There’s a little less demand for oil — people may be driving less, fuel-efficient cars are popular — but it’s mostly that there’s a crap ton of supply. There’s been a huge, global overproduction of oil, and that’s due to a bunch of different things that are happening all at once. The New York Times explains:

United States domestic production has nearly doubled over the last six years, pushing out oil imports that need to find another home. Saudi, Nigerian and Algerian oil that once was sold in the United States is suddenly competing for Asian markets, and the producers are forced to drop prices. Canadian and Iraqi oil production and exports are rising year after year. Even the Russians, with all their economic problems, manage to keep pumping.

OPEC (Organisation of Petroleum Exporting Countries) has a lot of power in stabilising these falling prices. The countries that make up this organisation produce about 40 per cent of the world’s crude oil, according to the US Energy Information Association. Governments around the world have been urging OPEC to slow down production and stabilise the market. Again, there are a lot of political factors involved, but in short, OPEC isn’t doing that, which means there’s still a huge amount of supply, which means prices are plummeting.

Extra Cash In Your Pocket, For Now

For most of us, cheap oil has been a welcome change. You’re not spending as much on petrol, you’ve got extra cash to save, and hey — you can finally take a long road trip without destroying your budget.

In terms of the economy and the everyday consumer, this is the main benefit: more cash in your pocket while prices are low. According to AAA, American consumers saved over $US115 billion in petrol last year.

Economists say cheap oil also slows inflation, too. Pretty much everything relies on oil in some way or another, so when oil prices go down, theoretically, that keeps the price of everything else nice and low. Which is great for the everyday consumer, at least in the short-term. The Wall Street Journal‘s national economics correspondent Josh Zumbrun says:

The bottom line is that lower prices boost GDP [Gross Domestic Product] and consumer spending but lowers overall inflation pretty dramatically. If prices are this low for the next year it will be a pretty big boost to consumers.

He adds that, over time, though, things have a way of levelling off. We’ll get used to lower prices and spend more elsewhere.

Interestingly, you’d expect flight prices to drop, too, as airlines save money on fuel costs. But that hasn’t happened yet. Airlines claim they haven’t dropped prices because demand is still so high, but some analysts argue the airline industry has become one big oligopoly. In short, the big players just won’t compete with each other.

The Risk of Deflation Destroying the Economy

Slow inflation isn’t always a good thing. It can signify a weak economy, and worst case, lead to deflation, the “nightmare scenario” for economists, according to NPR.

To understand why, imagine you own a factory. To make your product, you first must purchase parts and raw materials. You promise workers a certain wage. You borrow money to expand.

All of these transactions are based on the idea that you will be able to sell your goods at a particular price. But what if prices start falling?

Suddenly, you can’t afford to repay your loan or live up to your contract with workers. You can’t afford the parts that already are sitting on your inventory shelves. You have to start selling products at a loss, even as your competitors are slashing their prices. The downward pressure creates a vicious cycle that quickly leads to a broad plunge in the value of businesses, homes and other investments.

In short, falling prices mean businesses suffer, which means people lose jobs and stop spending money. Eventually, we run out of money and start defaulting on our loans and mortgages. Then, banks suffer, and the whole economy is in a giant slump.

The bottom line is, too much inflation isn’t a good thing, but neither is too little of it. Overall, the US Federal Reserve, who works to keep things balanced, wants to see a steady rate of 2 per cent inflation. In 2014, the US inflation rate was at 0.4 per cent and as of the end of 2015, it was at 0.5 per cent.

Some worry these falling oil prices will eventually lead to deflation and cause a recession. It’s hard to predict the future, but for now, that’s just a fear.

Some Economies Are Suffering, Though

That’s not to say it’s all good right now, though. While some of us are enjoying the savings, many others are feeling the blow of cheap oil.

My parents are a perfect example of the impact of cheap petrol on the economy. My dad, who owns a small business in the energy industry, is feeling the pain. Energy companies aren’t making as much money, so they’re not buying his services. My mum, on the other hand, is basking in the glory of filling up her car for less than $60. Everyday consumers are saving some cash, but those in the energy sector (the part of our economy made up of and invested in energy) are losing a lot of it.

Oil producing countries and states have been feeling this blow for a while now. Jobs are drying up. Wealth inequality issues are getting worse. Low oil prices have an impact on countries around the world. Nigeria, for example, relies on oil to fuel its already shaky economy, and now that prices are plummeting, politicians are looking for other answers. Christine Lagarde, Managing Director of the International Monetary Fund recently said in a speech:

The new reality of low oil prices and low oil revenues means that the fiscal challenge facing government is no longer about how to divide the proceeds of Nigeria’s oil wealth but what needs to be done so that Nigeria can deliver to its people the public services they deserve — be it in education, health or infrastructure.

The New York Times adds that Persian Gulf states are less likely to invest their money globally, and they may cut aid to some countries. Obviously, there’s a huge global impact to lower oil prices.

In the US alone, there were 94,509 announced layoffs in the energy industry last year, which is about 15 per cent of the total layoffs for the year. Low prices weaken the energy sector. This puts a bit of a dent in the overall economy, too.

It’s impossible to know the future, and everyone is kind of at a loss about what will happen next. But the Energy Information Administration predicts oil will increase to $US50 ($72) a barrel next year (Right now it’s at about $US35 [$50]). That’s not a huge jump, but it may ward off some of the potentially negative effects of cheap oil. In the meantime, all we can do is enjoy that super cheap petrol and hope for the best.

Comments

7 responses to “What Cheap Petrol Means For The Economy (And Your Wallet)”

The real reason the cost of oil is so low is because the Saudis (and other OPEC nations) have drastically increased their own production in an attempt to price the US out of the market.

Bear in mind that some of the OPEC nations are almost entirely dependent on oil revenue for GDP. They’ve relied on an voracious export market buying whatever is supplied and have used that as a mechanism to control prices.

Up until recently it wasn’t economically viable for the US to produce much oil. Shale and other sources were too expensive to extract from and OPEC oil was cheap. Presumably in an effort to free themselves from that dependence, and because economic factors made it more favourable (e.g. cheap labour during recessions) the US ramped up production.

With more oil on the market of course Keynes applied and prices dropped. OPEC had two options. 1) Cut production and stabilise the price, but lose export sales 2) Crank up supply and plummet the price.

Needless to say, they took option 2. Anticipating that eventually the price per barrel will drop to a point at which the US would be producing at a loss. And which point, OPEC recaptures the market.

@rickinoz Finally! Someone with some sense.

You’re wrong. Any change in oil prices equals higher petrol prices in Australia, at least for a bit. Because AusLogic.

Dat Australian Tax!

I agree, anything causes increase in petrol prices in Australia. Nothing will make it fall as we have too many middlemen and prices can remain high artificially indefinately.

If electric vehicles became efficient and cheaper, demand might fall but I think the government will do something to protect their petrol tax revenue and increase the cost of car charging or recover cost in another way such as a road usage charge.

First Saudi’s Are selling oil to American (Aramco) at a flat rate of SR00.65 per liters. SO it’s about 20c in australian dollar. So don’t blame middle east that the prices are high.

And why should we care if there is deflation in oil prices. The only ones that will suffer are the corrupted politicians in the US.

no, they’ll just pass on the cost.