Money rules might be simple, but they’re not always easy to stick to. If you want to build wealth, you have to constantly work on your money habits and rethink your relationship with money. Here are some of the best personal finance tips we’ve shared over the years that everyone should learn or relearn.

Illustration by ClkerFreeVectorImages.

10. There’s No One-Size-Fits-All Approach

Despite this post’s confident headline and the tips we share so assuredly below, let’s start off by saying that personal finance is, well, personal. Rules of thumb don’t apply to every single person in every situation, and even the experts don’t agree on many things, like whether to pay your mortgage off early or if you should use credit cards. Sometimes rules of thumb given as advice are really unhelpful, like telling someone to just “spend less than you earn.”

When you’re broke, for example, you might need to profile of three people with three salaries shows. So listen to money advice, but adjust it for your situation as needed.

9. Some Money Rules Never Go Out of Style

That said, there are some personal finance basics that everyone would benefit from learning, especially when this isn’t a topic that’s taught in schools. The most important personal finance rules don’t change — including the most basic truth that you need to have a gap between your income and your spending, whether you’re spending less than you earn or earning more than you spend (same thing, but subtle difference in perspective). Here are 10 good financial rules of thumb you can use as yardsticks.

8. Money Can Buy Happiness (But It Depends on Where You Spend It)

Money is a means to an end. While it can’t buy you love, it can buy you happiness — if you prioritise your spending on the right purchases, such as experiences and helping out others. When deciding where to spend your cold hard-earned cash, look to those purchases you’ll spend the most time with.

7. You Need a Budget

A budget helps you figure out where your money should go; without one (or without tracking it), you might find yourself thinking that money is just vanishing from your wallet. If you’ve never created a budget before, this is how to do it. It’s an important step even when you’re broke. After setting up a budget and tracking your spending against it, you’ll find the things you waste the most money on (we have spending categories in common, particularly food). Give every dollar a purpose and it will be easier to meet your financial goals.

6. Managing Money Is Immensely Easier If You Automate Your Finances

Even with a budget and a great plan, the truth is human nature trips us up when it comes to money. Automate your finances, however, and you can trick yourself into saving more, avoid temptations, and spend less time managing your accounts. You can save money without even trying! Here’s an infographic.

5. Always Negotiate Your Salary

Always. The biggest salary negotiation mistake is not doing it. Don’t be afraid to negotiate, as if your potential future employer might see you as a money-grubbing employee — hiring managers actually expect it of applicants and build that into their offer proposals. If you don’t negotiate your salary, it could cost you $US500,000 in the course of your career. So here’s how to negotiate your salary.

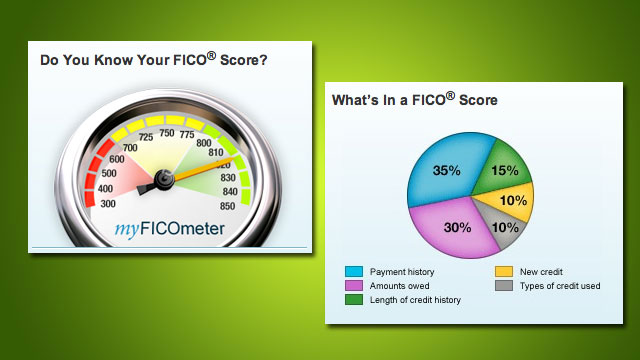

4. Protect Your Credit

Your credit history and credit score might not seem as easy to manage as cash, but credit is both a powerful tool and a valuable asset. You use it for buying homes and cars as well as for qualifying for lower insurance rates and getting jobs. Here are 10 ways you can improve your credit score immediately, how to check your credit score, how many credit cards you should have, and how to make sure those credit cards are protected from identity theft.

3. How We Think About Money Is the Biggest Game-Changer

Personal finance might be a numbers game, but how we think about money dictates how well we play it. We’ve learned that even just a bit of gratitude can improve spending habits and that it takes work to conquer a scarcity mindset (or fear of being poor). We have to trick ourselves to save money because we often fluctuate between feeling rich and feeling poor, feeling frugal and wanting to spend. The greatest money hacks are actually mind hacks.

2. The Earlier You Start Saving, the Better

This is something we probably all intuitively know, but it’s not until you witness the power of compounding and how time is your most powerful asset when you’re young that you realise, hell, I should have started saving yesterday (or last year or last decade). Not making a habit of saving early is the biggest money mistake we make, according to Warren Buffet. (Look at this retirement savings chart if you’re not convinced.) That said, it’s never too late to start saving. You can still catch up. Here’s what you should know about saving for retirement, including our beginner’s guide to investing.

1. Learning About Money Is an Ongoing Process. Keep Learning from Others

Finally, to circle back to tip number ten, your financial situation will change — and keep changing. The financial environment will also keep fluctuating. Stay on top of this by being open to new advice and regularly challenging your money assumptions. Other peoples’ experiences can help too. These are the most common money mistakes people make, by age group, and the dumb money mistakes I made when I was younger. We also recommend picking up a solid personal finance book or two, such as I Will Teach You to Be Rich, reviewed here. If you’ve never learned how to manage your money, don’t worry, we’ve got you covered in our basic guide here.

Comments

3 responses to “Top 10 Things About Money Everyone Should Know”

The best thing you can possibly do is to get yourself a Bank Charter, otherwise known as a license to print money.

Unfortunately you only get one of these by playing golf with the right people.

If you do manage it you can dupe people into giving you signed bits of paper with ‘Mortgage’ written on them that you can call ‘assets’ …and sim-sala-bim, a database entry and abracadabra you just created a few hundred grand and the dupe’s will pay you big chunks of interest on it for perhaps the next 30 years…yayyyy

(if you think this sounds like conspiracy theory from a raving lunatic please invest a couple of hours researching how banks work)

That’s a lot of hyperlinks.