Teaching your kids to work within a budget early on in their lives pays off for them down the road. Even when very young, kids are ready for the basic idea, and including them in your own budget planning as they get older helps them develop good habits from the start.

Pictures: Andrei Shumskiy. motleypixel, Tax Credits, ota_photos, gusmaru

I didn’t learn to budget my money when I was young. The mechanics of budgeting aren’t hard to pick up later, but what I really missed out on was the chance to build good money habits early on. And, like most habits, those get harder to form as you get older and bad habits have had the chance to take root.

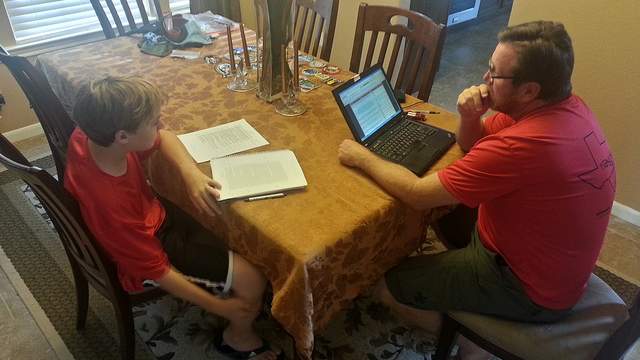

Include Your Kids When Planning Finances

I realised when they were a bit younger (now 17 and 14, for the record) that we often gave our kids mixed messages about money without really intending to. My wife and I might be complaining about a financial situation one day and making plans for a family holiday the next. Or talking about how we couldn’t afford something and then going out and buying something soon after. While those things made sense to us, we had context that our kids didn’t and it could be hard for them to figure out what was going on. That sometimes led to worry.

Including your kids in your family’s financial planning rewards them with important tools they’ll need later in life. I’m not suggesting that you ought to include your kids in all of your family’s financial planning or discussions. The appropriate level of inclusion for your kids is a decision each family has to make for themselves. But you can eliminate a lot of the mystery and fear that can accompany financial matters by letting them in on the game.

Use Pocket Money As A Teaching Tool

There are different schools of thought on pocket money. Some parents give it; some don’t. Some people tie pocket money to household chores, while others don’t. That’s a decision for you to make, and there are perfectly valid reasons on all sides.

Here are a couple of things to think about:

- Giving kids regular pocket money provides them a chance to learn how to budget using their own money. They know how much they will be getting and when.

- If you tie pocket money to chores, then presumably kids don’t get their pocket money when chores aren’t done. While that’s a perfectly reasonable arrangement, they aren’t able to continue building the budgeting habit when they don’t get their pocket money. You’ll need to find a way to work around that.

As you can probably guess, we do give our kids pocket money, and we don’t tie it to chores. Our thinking on this is that chores are something kids (and adults) ought to be pitching in with just because they’re part of a family. After all, I don’t expect to be paid for doing what needs to be done around the house.

Pocket money is purely a teaching tool for our kids to learn how to manage the regular flow of money. We figured it should give them enough money to buy some small things they want but also require them to save for bigger things.

How much pocket money to give is again totally up to each family to decide. We use a simple rule that adjusts as our kids age, so we settled on $2 per week for each year they are old. Our 17-year-old gets $34 per week. By the way, we also apply that rule to ourselves for our own spending accounts.

Keep it Simple For Really Young Kids

You don’t need to include really young kids in planning your actual budget or helping with financial decisions. It’s too complicated a subject for them, and they won’t get much out of it. What you want them to learn is that they have the power to direct where their money goes, whatever the source. Choices they make now impact the future.

We used a four-jar method when our kids were young. It’s an old trick that works well. In fact, Elmo himself talked about using a three-jar method:

In Elmo’s version, the three jars are For You (sharing), For Me (spending) and For Later (saving). We split saving into two jars, saving and investing, so our four jars worked like this:

- The Spending jar held money that they could spend however they wanted (within reason, of course).

- The Sharing was their money to donate to whatever cause they fancied. For donations, it really helps if whatever they donate money to gives them some kind of tangible feedback, whether that’s just a thank-you card or a picture of somebody they’re helping.

- The Saving jar was for short-term savings. Maybe they wanted to buy a toy that they couldn’t afford with just a week’s worth of pocket money.

- The Investing jar was for long-term savings. Maybe a big LEGO set or even a new bike. This obviously isn’t real investing. At this age, we really just wanted to get across the idea of short-term vs long-term savings. As they got older, we introduced the idea of interest — that money you saved could actually earn more money.

How they split their pocket money up between the jars should be up to them, but don’t be afraid to make some guidelines. And don’t forget to make it fun. Glue stickers or pictures to the jars showing what each represents, and maybe give them a little journal where you help them record how much is in each jar, what they’re saving for, who they’d like to give to and so on.

Here’s a look at some of the lessons you might consider teaching kids when they’re this age:

- Saving money now means something in the future.

- There’s never enough money to buy everything you want. You have to prioritise.

- Sometimes you have to wait before you can have something you really want.

- Keeping track of your money gives you power.

- Spending less on things means you have more money for other things. Kids love to help you cut out vouchers!

You can also talk to kids a little bit about your own finances — whatever feels comfortable to you. We let them know that just like them, we had money come in every week (in our case, people paid us to do work for them) and just like them, we had to decide what to do with that money.

Build On The Basics As Your Kids Get Older

As your kids get older, consider beginning to include them in your actual household budget planning and maybe even in some financial decisions. When they’re still young (preteen), you want to teach them the basics of budgeting. You get paid for working. You have a set amount of money coming into the household and regular expenses. Whatever money is left over after expenses, you decide what you should save and what you can spend.

As they grow into their teens, get them more involved and deepen the lessons. Show them the value of thinking about your expenses, how you might cut them, and how to save money in different ways.

Here are some of the lessons to think about teaching as your child grows older:

- Privacy is important to a family. If you discuss your real salary and expenses with kids this age, it’s an ideal time to talk about privacy. There are certain things about the inner workings of a family that are not appropriate to talk about outside the family. Of course, you’ll have to decide when your kids are ready for that.

- Everybody deserves to have some money that only they are accountable for. You may want to track what your kids spend money on. That’s fine. I’m not really talking about privacy here. Instead, I’m suggesting that kids should get to decide (within reason) what to do with their own money. This is their chance to make mistakes and poor decisions and learn from them.

- Families make financial decisions together. Think about what financial decisions kids can help plan. You could let them help decide about charitable donations, budgeting for family holidays and so on.

- There are different ways to save money. Show your kids different methods for saving money. It’s a great time to start learning about interest rates, and risk vs reward. It’s also a good time to teach that investing is different to saving.

- There are different ways to spend money. Teach them the difference between debit and credit cards. Show them how interest can work against you when you borrow just as powerfully as it can work for you when you save. As soon as they hit university, they will be inundated with credit and other easy ways to spend (importance of keeping track).

- You can be a smarter consumer. Teach them to do research and ask questions before making purchases. Is it something they need? Are they replacing something broken? Do they have something else that will work just as well? What advantages does the new one offer?

Teaching your kids good budgeting habits early can save them a lot of headaches later on. Start with the basics, add on as they grow, and always be on the lookout for teachable moments. When the mobile phone bill arrives, decipher it with them. Talk to them about big purchases, show them how you do research and make decisions. Let them be part of the discussion when you’re deciding whether to splurge on a bigger holiday or add to your emergency fund.

By all means, make your kids a part of your financial victories as well. Let them click send or lick the envelope when you make that final car payment.

Comments