Sorry to be the one to tell you this, but your brain is just not evolved to process big numbers. In our journey from hunter-gatherers to wage slaves, homo sapiens never quite evolved the mental machinery needed to efficiently process the high numbers we typically face when doing things like buying cars, taking out mortgages and saving for retirement.

Illustration: Tina Mailhot-Roberge

This post originally appeared on Bargaineering.

It makes sense in evolutionary terms that we wouldn’t necessarily need to be able to deal efficiently with big numbers, says Sara Cordes, an assistant professor of psychology at Boston College.

“We needed to keep track of numbers in order to keep track of our number of offspring, or to keep track of the number of nearby predators, or the number of apples available at a nearby tree,” says Cordes. “It was very rare to encounter many, many things, unless we’re talking about small items like swarms of bees, in which case it’s a swarm, so who cares how many there are.”

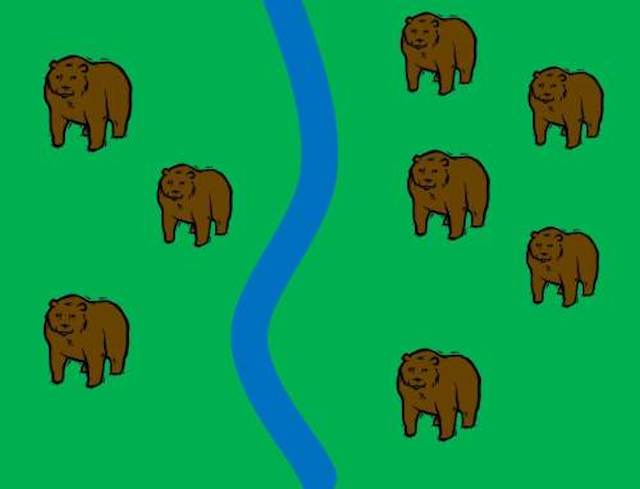

So looking at the picture below, that would be a question like, “Which side of the river should we set up camp on?” Your brain probably answers this one easily: “The left side because it has fewer menacing clipart bears.”

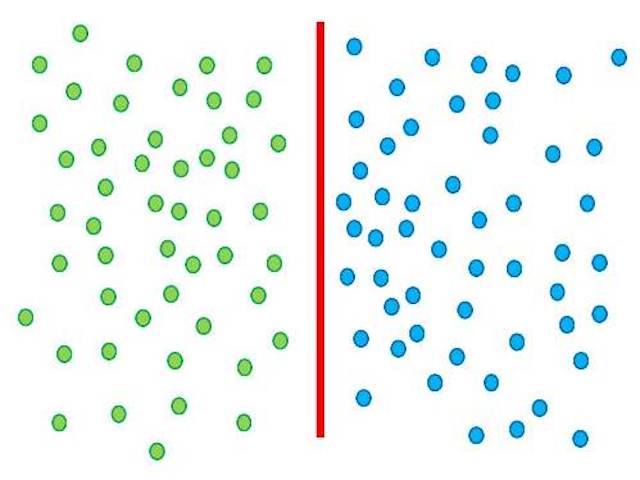

That’s a lot different from many of the numerical questions we deal with in our modern financial lives, which look more like this:

Which side has more dots? Without counting, your poor brain most likely doesn’t have any clue, but that relatively subtle difference is akin to what you’d encounter in, say, deciding whether to go for a 60-month car loan and put down $3000 or go for a 48-month car loan and put down $2500.

“Our ability to keep track of numbers decreases as the numbers increase,” says Cordes. “It’s known as scalar variability… the bigger a number gets, the noisier and fuzzier your estimate gets.”

One defence your brain sometimes puts up against this fuzziness is looking at proportions rather than absolute numbers. In other words, your brain can look at numbers and say, “I’m not really sure what this large mass of objects means, but I do know that it’s about the same as this other mass of objects.”

Going back to the examples above, there are 50 green dots on the left side and 52 blue dots on the right. That’s exactly the same difference in absolute terms between the number of menacing clipart bears on the either side of the river in the first illustration, but because there are so many more dots, your brain probably perceives them as about the same.

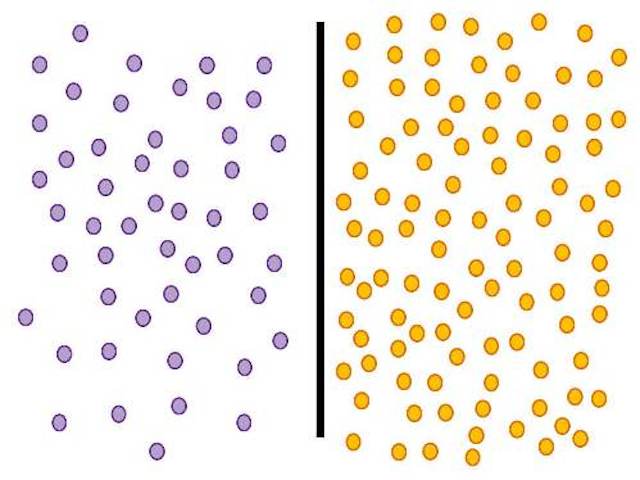

On the other hand, take a look at the illustration below:

Even though there are a lot of dots, it’s fairly easy to tell that there are more dots on the right side because the proportional difference is significant: 50 vs. 100, or 1:2.

The Problem with Proportions

Proportionality is a great workaround, but it only gets you so far because it’s inherently imprecise. Especially with large purchases, a relatively small difference proportionally can make a huge difference in absolute terms.

People trying to sell you things use this to their advantage this all the time. For example, say you go to a car dealership and ask to test drive the base model. As has often been the case in my experience, the salesman gives a feigned look of chagrin and says “Sorry but we don’t have one of those on the lot right now. But we do have an LX model you can try out.”

You drive it, and it’s great. The engine is peppy, the seats are nice and it’s got the electronic doohickey that everyone is getting now, and you just love the doohickey. “How much?” you ask. “Well, the base model is $22,100,” the dealer says helpfully. “This one is only $25,500, but I can probably come down on that a little.”

“That’s not too much more,” your proportion-loving brain tells you, seeing that the price of the LX model is a little over 1/7 higher than the base model, for a ratio of a little more than 8:7 between the LX model on one side and the base model on the other. But in absolute terms, the price difference is pretty huge: $3400, which would take more than 154 hours to earn at the US median hourly wage of $22.01.

Think about that for a second. If someone asked you to work for a whole month for them, and in return they promised to pay you in slightly more comfortable seats, a little more pep in the accelerator and an electronic doohickey on the dash of your car, I think you’d probably at least think a little while before saying yes.

“Generally, as the numbers get larger you’re more inclined to think about it in relative terms,” Cordes says. “Framing is absolutely key.”

Why This Is Important for Your Finances

What all this means is that if you’re if you’re trying to deal with large numbers based on what your “gut” is telling you, you’re unlikely to have much success. Fortunately for us, humans eventually developed a set of tools to help us make sense of large numbers: mathematics.

“Symbolic or formal mathematics is our way of talking about number in an exact way,” Cordes says. “If we were only to rely upon our mental representation of numbers, we’d have these sort of fuzzy approximate understandings of how many items are in a set.”

“But maths sucks and I hate it,” you might be saying in your head right now. As a former liberal arts major, I agree with you. It really does. But sometimes in life there are no good choices, and the scientific evidence out there strongly suggests that getting better at maths is one of the very few things people can do to substantially improve the quality of their financial decisions.

I’ve heard everything from visualising success through the “The Secret” to giving up gossip to calling people on their birthday cited as ways to become richer. Those things sound like things that could be much more fun than becoming better at maths, but the only problem is I have not found one scientific study that links calling people on their birthday to making better financial decisions. There are, however, plenty of studies that link mathematical competence to better financial results.

Cordes points to one study conducted by researchers from the Federal Reserve Bank of Atlanta, the University of Lausanne and Columbia University interviewed a set of subprime mortgage borrowers, asking them a series of questions designed to test their ability in mathematics. Then, they divided those subprime borrowers into four groups in order of their mathematical skills. The bottom two groups showed foreclosure rates of over 20 per cent, the top group had a foreclosure rate of 7 per cent.

“Basic numeracy abilities seem to be important for financial planning,” says Cordes. “There have been a number of studies showing that your ability simply to answer basic number questions like ‘What is half of 500?’ seems to be related to their tendency to default on a mortgage or to make better decisions on pension plans and other financial decisions.”

How big numbers short-circuit your brain and how to fight back [Bargaineering]

Claes Bell is the editor of Bargaineering.com, writer of personal finance blogs, and co-author of @FutureMilGuide. You can email him at [email protected].

Comments

One response to “How Big Numbers Short-Circuit Your Brain And Your Finances”

I don’t think evolution has anything to do with this. Continually blaming everything on evolution is not helpful and tends to detract from our ability to develop better solutions.