One big lesson we learned from the housing crisis: Don’t buy more home than you can afford. There are a handful of rules for figuring out what that amount is, but this one considers the additional costs, beyond home price. With this rule, all of your housing-related expenses should be no more than 25 per cent of your gross income.

Image via Business Insider.

Business Insider shares this rule from personal finance book On My Own Two Feet. In it, authors explain what exactly these expenses are:

- Mortgage payment

- Property taxes

- Insurance

- Maintenance

- Upkeep

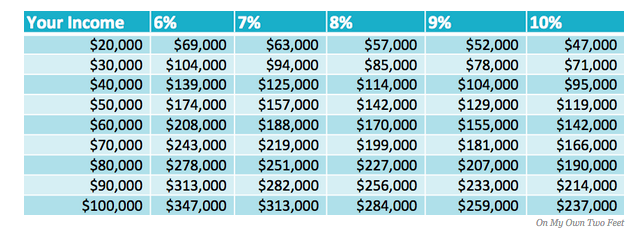

Like any rule of thumb, your mileage will vary and you should consider all of the factors that might affect your finances. But the overall idea is that if your housing expenses are more than 25 per cent, you won’t have enough to budget for other expenses. For quick reference, Business Insider offers a chart (above) to see how much, generally, you should spend on a home, considering the rule and interest rates.

Check it out at the link below.

How Much You Should Spend on a Home [Business Insider]

Comments

5 responses to “Decide How Much Home You Can Afford With The 25% Rule Of Thumb”

I’d be really curious for someone to chime in with how relevant this is for Australia? I believe mortgage payments are tax deductible in the US so that might change things a bit?

a loan of 300k would give you mortgage repayments equal to 25% the average full time gross income of 80k if the rate was 5%. that’s $1666 a month.

And that’s just the mortgage. Insurance, rates and water would be around 5k a year in Brisbane. Add another, what? 3k for general upkeep? 8k. Thats $666 a month, leaving $1000 for repayments… meaning you could borrow 180k…. and that doesn’t include electricity.

In short, I envy US housing costs.. and hate Australia’s housing costs…

When I bought 10 years ago, I borrowed around $250k on an income of $55k or so. Repayments peaked at $900/pay a little over a year into the loan, and while things were a little tight, they were managable.

When GFC hit, and rates went down, I left it at that peak, so am still paying that $900/pay, but even with quite a few payrises since then that $900/pay is still close on 50% of my take home pay.

Something I remember seeing years ago was how high our disposable income is. Its one of the reasons things cost so much in Australia – we simply have more to spend. So thats how I approached it – of my disposable income, what did I need just to live off?

What was left over was accommodation, and what I could afford to pay either as rent or mortgage. And it turned out to be plenty enough to pay down a mortgage, something I havent regretted since.

Judging by this nobody can really afford a house in Australia, especially the capitals….oooooo wait, they can’t

Yeah…. This is not at all relevant for the Australian market. Apart from anything, the HIGHEST price for a house – not a first house, but a house – is under $350k. Assuming interest rates aren’t going to change in the next 30 years (ie will stay under 6 or 7%)….

I’m in Brisbane, and trying to find a house (that I would live in, in a neighbourhood I would live in) for under that is pretty close to impossible… Thankfully I’m not in Melbourne or Sydney