Getting out of debt isn’t easy, and while there’s plenty of practical advice to help, the psychological toll is a huge, often-overlooked obstacle. When you feel utterly powerless against debt, it only makes the process more difficult. While it takes money to get the job done, shifting your mindset to an empowered one will help you through the long slog to financial freedom.

Illustration by: Sam Woolley

In Dear Debt, personal finance author Melanie Lockert describes her own story about paying over $US80,000 ($105,975) worth of student loan debt in less than five years. She says that while all of the basic money advice is a necessary part of the plan, what helped her more than anything was changing the way she thought about money.

Learn to Practice Gratitude

It’s only natural to feel resentful when you’re paying off debt. You have to give up certain luxuries in order to pay down your balance, even small luxuries. When your balance is massive, it feels like you have to give up on those expenses forever. Lockert told us:

When I was in debt and struggling, I was upset by all of the things that I didn’t have. All of the things I couldn’t do. It was paralyzing and made me want to spend more on things to make myself feel better.

After dealing with depression, Lockert saw a therapist at her grad school to talk about her issues. At her therapist’s suggestion, she started writing down three things she was grateful for every day.

They could be anything at all. So I put things down like a warm cup of coffee, having a place to live and my family. Once I shifted my mindset and focused on what I was grateful for rather than what I was missing, I realised I didn’t need to spend on other things. I was already “rich” in many other ways.

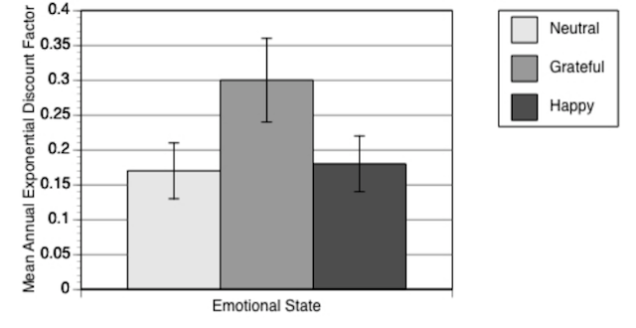

Gratitude really can go a long way toward nixing some of the financial impulses that make it harder to get out of debt. A study published in Psychological Science (PDF) backs this up. Before being presented with a money decision, subjects were asked to write about an experience based on one of three emotions: happiness, gratitude, or “neutral.” Researchers then asked them if they wanted a little bit of money now or a larger amount later. The subjects who expressed gratitude were nearly twice as much more likely to delay their gratification and make the smarter overall financial decision. You can see how results varied:

I can relate to Lockert’s experience, too. I spent years operating with a mindset of scarcity. When I finally learned to be grateful for the stuff I had instead of worried about the stuff I didn’t, I felt more confident and empowered. This made it easier to stop emotional spending, but it also encouraged me to learn about investing, take risks in my career, and overcome my fear of money in general. When you feel confident and empowered, it’s easier to tackle overwhelming goals, too.

Turn Jealousy Into Productivity

Jealousy is destructive in general, and when it comes to your finances, jealousy often leads to bad decisions. The whole concept of ‘keeping up with the Joneses‘ is based on jealousy. For example, like most people, when I feel jealous, I feel inadequate. In the past, when I felt inadequate, I would often compensate with buying clothes or other distractions. Subconsciously, I figured I looked good enough, I’d feel worthwhile. Not only is this emotionally destructive, it destroyed my finances, too.

Lifehacker alum Melanie Pinola wrote about her own experience overcoming jealousy. She said it boiled down to being more mindful, embracing gratitude, and learning that praise is not a finite resource. Trent Hamm’s ‘Five Whys Method‘ helped me. Over at The Simple Dollar, Hamm writes:

The whole issue of jealousy comes down to desire. For some reason, whether you consciously recognise it or not, you desire something that the other person has. You want it in your life. The question is, why do you want it in your life? I like to use the ‘five whys’ when handling a question like this. Whenever I’m trying to answer a “why” question, I repeat it five times, asking it of the answer I come up with for each question.

This method is useful because you get to the core of your jealousy and discover something much more productive: a goal. From a debt perspective, this is powerful because it keeps you on track with your goals and keeps you from making decisions that undo all of your good work, like spending on stuff you don’t need just to get back into debt. Not only can you keep jealousy from destroying your finances, you can actually turn into something much more productive. Lockert explains:

If you’re jealous of someone’s success, let that inspire you to work harder. If they can do it, so can you. Everyone has to start somewhere, and you can’t compare yourself to someone else’s journey.

In her book, Lockert explains how she used jealousy to her advantage, too, by networking. She reached out to peers she envied and asked for insight and career advice. This serves a practical and an emotional purpose. You turn your negative feelings into something more positive, which makes you less prone to buying crap you don’t need to compensate, digging further into debt. However, you also expand your network this way, opening yourself up to more earning opportunities.

Look for Opportunities to Pay Off More Debt

You can be as frugal as possible and cut all your expenses to the bone, but earning more money to begin with will get you five steps farther.

That’s a lot easier said than done, though. Most people don’t have jobs that offer unlimited pay. Most people don’t have free time to pick up a second job or side gig. This is where resourcefulness comes in.

I realised that debt was ruling my life in more ways than one, and that my situation kept me in a negative feedback loop. I felt stuck and wasn’t sure how to get out of the situation. After feeling this way for more than a year, I knew I had to change, so I started to get into problem-solving mode. How could I get out of this situation? What could I do to turn this challenge into something else?

Sure, there are a lot of sell or rent around the house, but you might not have those things. At some point, you have to rule out the answers that don’t work for you and focus on opportunities instead. Lockert said:

Not being able to secure full-time work did a number on my self-esteem. I felt like I wasn’t worthy of a job or worthy of making money. Because of the struggle, I got into side-hustling to make more money. I worked as a brand ambassador, event assistant, pet sitter, mother’s helper, and more. I did whatever I could do. Once I stopped focusing on a traditional job, I realised there were money making opportunities all around me.

I started to believe I was a money-making machine and that I could leverage my skills, contacts and hustle into work. Work begets more work, especially if you do a killer job, follow-up and build your reputation.

Lockert started looking at her obstacles as opportunities. When I asked my mum how she managed to save ten thousand dollars and move us to a better neighbourhood on a minimum wage salary, she said the same thing: opportunities aren’t always fun. For example, her “opportunity” was overtime at her awful job. “Most people would not see that as an opportunity,” she admitted. But all she cared about was how to support her goal to move, go to school, and get a better job.

Of course, that solution isn’t going to work for everyone. The point is: you have to figure out what works for you. Learning to look for opportunities to pay off your debt will go a long way. Lockert puts it this way:

It can be hard to see the silver lining while working through challenges, but if you focus on creating an opportunity out of a challenge, you can move through the challenging situation even faster — and stay sane while your world feels like it’s crumbling. It’s really about activating hope, when things may feel hopeless.

Most of the debt advice you read emphasises the tools and tactics you need to get out of debt. Don’t get me wrong, those tools and methods aren’t just important to learn, they’re necessary. However, it’s easy to overlook the psychological toll of debt, and debt can really drag you down. It makes you feel defeated, helpless, and totally out of control. It’s difficult to conquer any goal when you feel that way. When you learn to deal with the emotional side of debt, it’s a lot easier to use those tools and methods effectively.

Comments

3 responses to “The Shift In Mindset That Will Help You Get Out Of Debt”

I usually make two suggestions to people. One, always spend something on yourself. Get into the habit of spending $50 to $100 a pay on yourself in some way, to reward yourself for getting through another pay period.

Doesnt have to be much, maybe a nice bottle of plonk, some new clothes (note, eventually, a good chance to recycle stuff you no longer wear, to make space for new stuff), or even put a couple of pays aside and get something a bit fancier, but if you do that, you ultimately run out of little money wasters to spend money on and find you have a better budget cycle.

Second thing I suggest is that people stop spending their change. Put it in a container, and every 3 months or so go take it to a bank with a coin counter and deposit it. If you need to tap into that change along the way, its a good sign you need to rethink your budget, because a household shouldnt need to penny pinch.

You’d be surprised how fast that can raise to something significant.

I put my coins in a container and I use them on my fortnightly fruit and veg markets shop. The stall operators never seem to like notes/large money so I think it works well for them, plus I feel like I got a bunch of “free” vegetables.

That works as well, good thinking. Its more about the idea of NEEDING to use that spare change, and making it useful. Simplest way for me is to simply bank it quarterly, or something like that, but the markets work just as well.

I know plenty of small businesses that cherish getting paid with change instead of a $50. And over the years I’ve noticed just how fast it adds up when you average dumping a couple of gold coins a day into a container.