Spend less than you earn, save your money, and — poof! — your financial problems are solved. If only it were this easy. Being broke sucks enough on its own, and then there are obstacles that make it extra hard for poor people to fight their way to financial security. For example, here are a few expenses that actually cost more for low-income individuals.

Illustration by Sam Woolley

Toilet Paper and Other Staples

Even if you’ve never heard the phrase “the toilet paper effect”, you’re undoubtedly familiar with how it works.

A study from the University of Michigan tracked the toilet paper purchases of over 100,000 American households for seven years. Researchers found that high income households bought toilet paper on sale 39 per cent of the time, compared to 28 per cent for low income households. They also bought more rolls on average compared to low income households. Overall, the study found that low income households pay about six per cent extra per sheet, and here’s what the researchers concluded:

the inability to buy in bulk inhibits the ability to time purchases to take advantage of sales, and the inability to accelerate purchase timing to buy on sale inhibits the ability to buy in bulk. We find that the financial losses low income households incur due to underutilization of these strategies can be as large as half of the savings they accrue by purchasing cheaper brands.

In other words, as the study’s title points out, Frugality is Hard to Afford. We’ve discussed this phenomenon in detail, too. It’s not just toilet paper. When you’re poor, it’s not easy to buy stuff in bulk or buy high-quality items that will last. There are a lot of hidden, systematic ways poor people pay more for stuff, and there are some expenses that aren’t so subtle.

Car Insurance

Car insurance premiums are tricky, and there are some surprising reasons why you might pay more for car insurance — you rent your home or you didn’t go to university, for example.

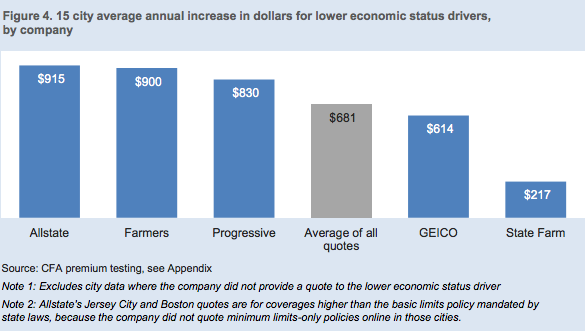

Recent research (PDF) from the Consumer Federation of America (CFA) found that lower income individuals pay more for their insurance, and it’s not because poor people are bad drivers. Specifically, the study found that good drivers pay $US681 ($913) more each year on average “due to personal characteristics associated with lower economic status”.

The CFA looked for quotes from five of the largest insurance carriers in the United States. They compared policies for two hypothetical men and two women who shared the same car model, address and driving record. They only changed socio-economic traits, and they found that insurers charged between 40 and 90 per cent more:

Sure, you could argue that car insurance premiums are more expensive for a reason, but the fact remains: They tend to be higher for low income individuals, even when those individuals are good drivers.

A University Education

This expense might come as a surprise. The general assumption is that the poorer you are, the more grants and scholarships you qualify for.

That may be true, but many universities, especially private ones, use a method called “gapping” to squeeze more money out of poorer students — or discourage them from attending altogether. Basically, those universities offer prospective low income students tuition packages that don’t really meet their financial needs. They underfund those students and save the aid for wealthier students who can afford to pay full tuition rates. A recent report from the New American Foundation explained:

…colleges are increasingly using their own institutional aid dollars as a “recruiting tool,” rather than as a means of meeting a student’s financial need…In practice, this means that the highest-achieving students, who often come from affluent families, receive the most generous financial aid packages from their schools.

In basic terms, this practice makes it more expensive for poor people to go to university. They will get aid, but it’s not enough. Meanwhile, wealthier students get more aid than they actually need. Of course, poorer students then take out even bigger loans to make up for the difference and then graduate with larger debt loads.

Banking and Other Financial Services

Bank fees make it expensive just to maintain your money in an account, which is ridiculous. They’re easy enough to get around, though — if you have the money.

For example, the Commonwealth Bank’s Everyday transaction account comes with a $4 monthly Smart Access fee. It’s waived if you deposit at least $2000 every month, which is no easy feat if you’re poor, though it’s a decent option if you have a job that earns enough and also allows you to sign up for direct deposit. You can also get around it if you have a balance of $50,000 or more in eligible contributing accounts.

The point is: There are solutions, but in practice, those solutions don’t seem to work well when you’re flat-out poor. Studies show that there are fewer financial service options for lower income individuals, so they rely on costly alternatives: Payday loans and other debt traps.

For example, a study from the US National Poverty Center found that 17 per cent of the unbanked say their application to open a bank account was denied. Many others find their existing bank accounts closed because the minimum balance was too low. Whatever the reason, not having access to these accounts makes it even harder to save, work toward financial security or build a nest egg. The reasonable mainstream services that are available to most of us just aren’t as accessible for low-income households, which means they pay a lot more for alternatives.

It’s easy to judge other people’s choices and simplify their solutions — just don’t fall into a debt trap, right? You’d be stupid to take out a payday loan. The problem is, there are limited alternatives for a lot of people. If you’re struggling financially, this isn’t to say there’s nothing you can do about your situation, but it does take overcoming some extra obstacles most people overlook. When you know what those obstacles are in the first place, you’re at least in a better position to find solutions.

Comments

19 responses to “The Stuff That Costs More When You’re Poor”

“…you might pay more for car insurance — you rent your home or you didn’t go to university, for example”

This is obviously a US article, so does anyone have any idea if this gouging goes on here? AFAIR, my car insurance company has never asked if I went to university.

A semi-adapted US article… You can see someone went in and update the bank reference to Commonwealth bank.

Nor mine.

More likely here it’s based on a simple risk assessment on the vehicle, for example: where it’s parked overnight.

Lower socio-economic areas typically = more crime = more risk = higher premiums.

I’d like to see other contributing factors included in these kind of comparisons. The toilet paper one, especially. Just saying that poor people end up paying more because they don’t buy in bulk, isn’t enough. I know plenty of poor people that DO buy in bulk, and plenty of “rich” people that don’t. It’s certainly a lot more nuanced than “I have no money so I’m just buying a single roll of toilet paper”. Certainly factor in experience (or age) and intelligence. Even if you’re poor, with enough experience and intelligence, you can come up with method for getting on the front foot, allowing you to take advantage of bulk buying savings. When you’re thick as a brick shit house, living week to week, and can’t see any way to get ahead, that’s when you end up falling for the single item price trap.

While I agree that common sense and intelligence comes into it, if you’re a single parent out of work with 4 kids and barely getting by financially, and it’s a choice between buying toilet paper in bulk to save a couple of dollars versus your kids eating something other than no-name 2 minute noodles for dinner every night for a week, the choice to buy a 2 or 4 roll pack of toilet paper would be pretty obvious.

Someone in truly dire straits financially doesn’t necessarily have the luxury of doing what they may be fully aware is the common sense thing to do.

Your dichotomy is so obviously fabricated that not only do I not think it’s valid, I honestly can’t believe that you think it’s valid…

So the difference between 4 kids having homebrand migoreng and a decent dinner, for a week, is “a couple of dollars”.

Completely disingenuous justification.

A random selection from Coles shows a 12-pack at $5.50 and the same product 24-pack at $9.

The difference is close to the ‘couple of dollars’ mentioned … except that you now have twice the bog roll so the $3.50 extra you spend now saves $2 (2 x 5.50 – 9) next time.

Do that twice and you’re ‘even’.

Or you spend that saving on the next ‘bog roll’ scenario (big box of Weetbix vs small one?).

And so on.

It may seem trivial to be arguing about $2 but this is the scale at which the failure to manage money begins.

Every purchasing decision (particularly when income is low) is serious and can snowball further into failure or be the start or recovery.

I didn’t say common sense came into it, I said experience. Yes it’s (largely) common sense that buying in bulk is cheaper, but it’s experience and intelligence that gives you the ability to manage and structure your finances in such a way to be able to take advantage of that situation.

It’s isn’t a choice between buying 2 minute noodles and 4 rolls of toilet paper. It’s about understanding where your money goes, places it can be better structured, and the pathway to take to get there.

I see the point you’re trying to make. But not all people have a good grasp on finances or budgeting. For some, it literally comes down to how much cash they have at that moment and a Maslowian list of priorities. Sadly there are some people here who don’t have bank accounts or savings and literally live subsistence week to week.

So while it may sound obvious to plan ahead and buy the bulk item cheaply now, that may simply not be an option for some if their entire weekly living expenses budget has to be under $50.

Nor can everyone easily see a way out of such situations. There was an ABC doco around 6 months ago (possibly 4 Corners) all about the poverty spiral and predatory nature of payday loans that trap people into them.

That’s literally my point, some people don’t have the experience (education) or intelligence to do this. That’s got nothing to do with their pay.

Please… obviously their are dumb rich people and smart rich people, and dumb poor people and smart poor people.

The theory is logically sound that *on average* statistically, the poor would be more likely to be forced to buy in smaller quantity and at inopportune times.

This false idea that poor people are somehow deserving of their state due to being lazy or unwise is exactly what allows income inequality to keep getting worse and worse…

Clearly the situation in Aus is better than the US. But we really need to start treating our poor with respect. Just because ACA has a story every week about another druggy who keeps having kids to live off the parental payments, doesn’t mean everyone is like that.

Nothing to do with how we treat people, just how smart and experienced people are.

I strongly suspect there would be a high correlation between this and economic situations. That said, I also stand by my idea that intelligent people with experience in dealing with money, no matter their income, will find the most advantageous way to manage it, just as well as someone with lots of money.

It’s not a burden on poor people, just people who don’t know how to manage their finances.

Considering minimum wage in Australia is $656.90 and would mean roughly a take home pay of $571 / week, As long as your pay goes into the account at the commonwealth account, then that would be no account fee. So your argument for the commonwealth bank is quite flawed. At the commonwealth bank, you only have to deposit money, you can take out / spend as much of that money as you want and you are still waived the fee.

and for all those people that dont earn mimimum wage, single parents, newstart, uni students, part time workers, specifically poor people, they get slugged a fee basically for being poor.

You need to put $571 per week into an account to avoid fees?

But you can remove as much as you need to?

The workaround is so obvious that anyone complaining that the fee is mandatory is actually being “slugged a fee” for being a dimwit.

There you go, took all of 30 seconds to find.

http://www.nab.com.au/personal/banking/transaction-accounts/nab-classic-banking

No they aren’t, the bank uses your money being there for investments to make them money, that’s how it works, all of those people listed are also given a lot of benefits from the government.

You’re pre-supposing that all poor people are employed full-time… when the reality is that a high proportion of impoverished people are most likely underemployed or unemployed.

I think Terry Pratchett put it best.

“The reason that the rich were so rich, Vimes reasoned, was because they managed to spend less money.

Take boots, for example. He earned thirty-eight dollars a month plus allowances. A really good pair of leather boots cost fifty dollars. But an affordable pair of boots, which were sort of OK for a season or two and then leaked like hell when the cardboard gave out, cost about ten dollars. Those were the kind of boots Vimes always bought, and wore until the soles were so thin that he could tell where he was in Ankh-Morpork on a foggy night by the feel of the cobbles.

But the thing was that good boots lasted for years and years. A man who could afford fifty dollars had a pair of boots that’d still be keeping his feet dry in ten years’ time, while the poor man who could only afford cheap boots would have spent a hundred dollars on boots in the same time and would still have wet feet.

This was the Captain Samuel Vimes ‘Boots’ theory of socioeconomic unfairness.”