Habits, behaviour, and emotion play a big role in how you manage money. If you want to change a habit, it helps to understand the behaviour behind it. Here are six ways our behaviour is influenced.

Photo by geralt.

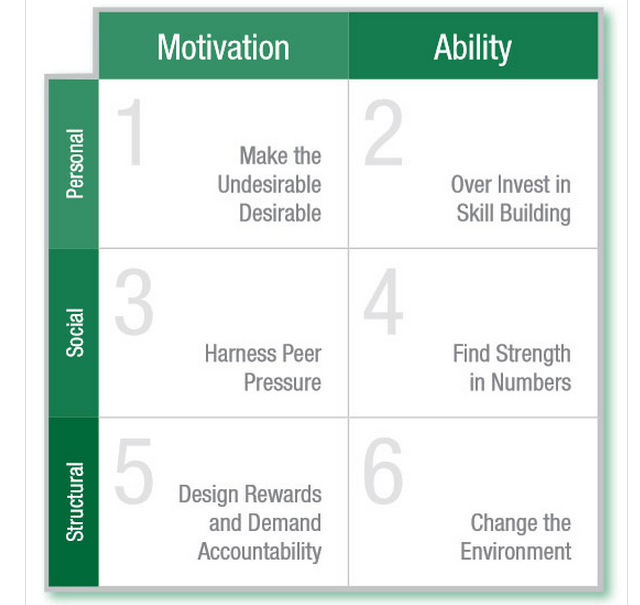

Over at Budgets are Sexy, writer J. Money points to research from author Joseph Grenny, who organises influence into the following six categories:

- Personal motivation

- Personal ability

- Social motivation

- Social ability

- Structural motivation

- Structural ability

In his research, Grenny breaks it down:

The first two domains, Personal Motivation and Ability, relate to sources of influence within an individual (motives and abilities) that determine their behavioural choices. The next two, Social Motivation and Ability, relate to how other people affect an individual’s choices. The final two, Structural Motivation and Ability, encompass the role of nonhuman factors, such as compensation systems, space, and technology.

He also provides a useful graphic to better illustrate what he’s talking about:

In the study, Grenny and his colleagues looked at the spending behaviour of children. They gave a research group of children $US40 and tempted them with really expensive candy. The point was to see how different temptations influenced them. For example, one temptation involved visual cues: photographs of children eating candy were in the room. This represented structural ability. Grenny presented tempting influences in each of the six categories and noted how the children’s choices changed.

When researchers removed the original temptations and replaced each influence with smarter financial influences, the children were more likely to save.

It’s just one study, sure. But this comes into play with personal finance quite a bit. For example, J. Money writes:

How many of these things have we probably experienced this week alone? Taste testing at Costco or Trader Joes? Friends buying up cool $UShit or planning to party hard this weekend? Using credit cards over cash? And what about running into ads everywhere we look?

It helps to think about our influences organised in this way. You get a better understanding of what affects your habits and why it affects them. Once you understand that, it’s a lot easier to resist, tweak, and redirect those habits. Check out the study below, and check out J. Money’s post for more insight.

10X Your Influence [VitalSmarts via Budgets are Sexy]

Comments

One response to “The Six Ways Your Financial Behaviour Is Manipulated”

7 – OzBargain