People assume you have to be rich to invest. They think investing is too risky. They believe they’re already investing because they own a home. These common myths keep people from building a basic investing portfolio. And, if you ever plan on retiring, chances are, you’ll need that portfolio. Don’t let these common investing myths get in your way.

Illustration by Tara Jacoby.

Myth: You need a lot of money to invest

You need money to make money investing, that much is true. But you don’t need a lot of money so don’t let this myth get in your way.

There are companies on the market that trade for less than ten bucks a share. We don’t recommend it, but you could even start investing for even less than a buck with some so-called penny stocks. So no, you don’t need a ton of cash to start investing.

But it’s also not smart to invest in a single company or asset. Your investing “portfolio” (all of the the stuff you’re invested in) should be diverse. Meaning, you want to invest in a bunch of different companies, bonds, and other assets. For this reason, we don’t recommend anything other than the traditional buy and hold strategy. The main point here is that you don’t need a fortune to get started in the market.

Myth: Investing is too risky

A lot of people shy from investing because they mistakenly think it’s like gambling. Sure, investing in a single asset is very risky (though your odds are probably still better than gambling). But investing in the broad market, over years, has pretty good odds. As financial expert Laurie Itkin told us:

Let’s say you spend $US5 a week on lottery tickets for 20 years. That’s $US260 a year or $US5,200 after 20 years. Will you hit the lottery? Perhaps, but your odds of winning are extremely low. The U.S. stock market on average returns about 8% a year. During the past three years it has done much better but there have been a couple of years where it’s done much worse, such as in 2008. But the longer the time horizon, the higher the probability that you will recognise average annual returns of 8%.

Also, gambling simply works differently than investing does. With gambling, the goal is for other people to lose money. The winner only makes money if other people lose. With investing, the goal is utilising the money for growth; no one has to lose in order to earn money.

That being said, there is some risk in investing. And some investments are riskier than others. Technically, yes, the market could tank and all of your assets could completely drop in value. But as long as you don’t sell when it tanks, history has proven you’ll bounce back and most likely hit that average return if you’re invested properly. The market always cycles, it’s filled with highs and lows, and peaks to not equal impending doom.

Considering inflation, not investing may actually be riskier. Most savings accounts earn interest at less than the rate of inflation, which means if you think just sticking your money under your mattress is a better option, you’re sort of losing money over time.

Myth: You can beat the market

Investing isn’t as unpredictable as gambling. It’s also not so predictable that you can time the market and beat it for huge returns.

With a boring, “set and forget” (or buy-and-hold) investment portfolio, you pick a handful of funds and let them do the work, without worrying about market timing. Over time, you should earn an average market return. Many brokers and financial firms say they can beat this return and earn you more money, but studies suggest this just isn’t true.

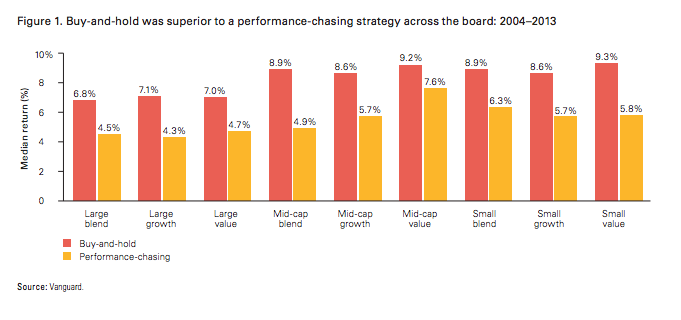

Vanguard published one such study. They compared a buy-and-hold investment strategy with a performance-chasing strategy. Comparing returns from 2004 to 2013, here’s what they found:

Investors are naturally drawn to top-performing actively managed funds. The result for many is a performance chasing approach in which current funds are sold from the portfolio to make room for recent “winners.” Vanguard research demonstrates that this behaviour is misguided, as a buy-and-hold strategy has outperformed performance-chasing over the past decade in all nine Morningstar equity style boxes.

You can see just how much the results varied:

Then again, Vanguard is a huge mutual fund company, so you might be sceptical of their results. A separate, peer-reviewed study published in the Journal of Finance looked at 2,076 mutual funds and how they performed over 32 years. The study reported that the number of fund managers who beat the benchmarks of these funds was “statistically indistinguishable from zero.”

Combine this with the fact that actively managed funds often come with higher fees and it seems especially silly. While investing isn’t quite as unpredictable as gambling, it’s also not so predictable that you can time it. As the old saying goes, it’s about your time in the market, not timing the market.

Myth: Gold is a classic, smart investment

When people worry about the economy, they tend to look for alternative investments. Gold and precious metals are usually sold as the go-to “safe” investment. Bankrate further explains:

Any hint of bad news brings out the gold bugs. One can barely listen to a news or talk radio station without hearing commercials for investing in gold. “A lot of them are selling to people’s fears and selling to their greed by overstating without necessarily telling the whole story,” says Michael Masiello, president of Masiello Retirement Solutions, a financial planning firm in Rochester, New York.

In reality, there’s nothing wrong with investing in gold or other alternatives. But you should know that their return only keeps up with inflation, so you’re not really earning much of a return.

But one non-Doomsday argument for investing in gold is that it’s a hedge against inflation. Financial expert J.D. Roth weighs in on this topic in a post for his site, Get Rich Slowly. He points out that gold enthusiasts argue that as prices rise, gold tends to retain its value. Roth counter-argues:

That’s true — but long term, that’s all that it does. There are other things that tend to keep their value during inflation, if that’s what you want. Real estate, for one. If you’re wanting to fight inflation, there are better options. In his book Stocks for the Long Run, Jeremy Siegel crunched the numbers to find the historical performance of several common investments. The results? Since 1926:

- Gold has a real return (meaning: “after-inflation return”) of about 1%.

- By my calculations (not Siegel’s), real estate also has a real return of about 1%.

- Bonds have returned about 5%, or about 2.4% after inflation.

- Stocks have returned an average of about 10% per year, and a real return of about 6.8%.

This isn’t to say that gold is a terrible investment. But a proper portfolio isn’t invested in any single asset. And if gold is your only asset, your portfolio won’t earn much. Over at the Atlantic, financial advisor David Marotta recommends keeping less than 3% of your portfolio in gold.

Myth #5: My home is an investment

People often consider themselves investors because they own a home. This has been widely debunked in recent years, but plenty of people still hold onto this idea. People tend to assume homes are appreciating assets, but this isn’t always true.

Yale economist and Nobel prize winner Robert Shiller actually crunched the numbers and started the debate on this topic. He points out that, overall, the housing market barely outpaces inflation. The Washington Post analysed his data and put a number on it. They reported that, over the past 100 years, home prices have only grown at a compound annual rate of 0.3%, adjusted for inflation.

Like gold, your single real estate asset might help protect you against inflation, but again, true investing is well-balanced stock and bond portfolio.

It’s not the most exciting option, but then again, a solid investment portfolio isn’t exciting. It’s boring, balanced, and steady. But popular perception is that investing is a dynamic rollercoaster ride, filled with staggering highs and lows and bold, active risks.

In reality, all it takes is picking a few funds and letting them grow over time. When you shed the myth from fact, investing is actually pretty simple.

Comments

4 responses to “Five Common Myths That Keep People From Investing, Debunked”

#5: Straya

Too right.

#5 is a bit interesting. I get what the article is saying about long-term appreciation, but it’s not the whole story.

I own a home. I no longer have a mortgage. I do have to pay rates and insurance, but it saves me over $20k per annum in rent (family of four). I certainly wouldn’t do anything different if I had my time again.

In buying your home and paying off your mortgage you have still incurred costs such as interest, the stamp duty, possibly mortgage insurance, etc. When these are factored in, the costs of owning a home can be more in the long run than renting. However, there are lots of factors that can influence this comparison such as how often you would move while renting or buying. The argument for renting being a better option is that you invest the money that you would have used for a deposit, and the small annual savings, over the typical 20-30 year term of a mortgage and end up with financial assets that are worth more than what the home would be. This all sounds good in theory, but in practice the majority of people who rent spend these savings rather than invest them, while home ownership is essentially an enforced savings/investment regime.