Most of us have a budget for our finances, and we may even have goals for what we’d like to save or pay off. But fewer of us have planned out exactly when we hope to achieve those goals.

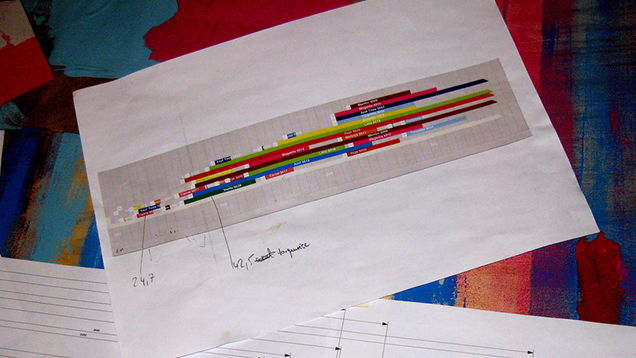

Photo by Neil Cummings

A few goals tend to come with a deadline built in. Your house or car loan has a term length that, at the end, you’re expected to have it paid off. Some credit cards offer no-interest plans with a deadline. Personal finance blog Money Ning, however, suggests having a timeline for all of your financial goals, so you know exactly when you want to achieve specific targets and how long it will take to get there:

Think about end dates for each of your financial priorities. Some of them may be far into the future, and it may seem silly to be tracking something that’s so far away. However, it’s helpful to have it all written down, so you can see the big picture. Next to each goal, put an actual date.

For example: Pay off Credit Card #1 — January 1, 2016

By doing this, you’re setting the intention for your goals and giving yourself a clear plan of action.

How do you deal with the time aspect of your finances? Do you use spreadsheets? Calendars? How do you mark out when you want to have certain financial events in order? Or do you prefer to manage what you can pay month to month and let the future sort itself out?

How to Successfully Manage Multiple Financial Priorities [Money Ning]

Comments

One response to “Do You Have A Financial Goals Timeline?”

Here is the link

http://moneyning.com/money-management/how-to-successfully-manage-multiple-financial-priorities/